Embedded finance is rapidly becoming one of the most transformative forces in fintech. At its core, embedded finance refers to the seamless integration of financial services—like payments, lending, insurance, or investing—directly into non-financial platforms and apps. This trend is blurring the lines between banks and everyday brands, enabling companies across sectors like retail, travel, healthcare, and logistics to offer financial products without becoming traditional banks. From ride-hailing apps offering instant driver payouts to e-commerce platforms providing buy-now-pay-later options, embedded finance is redefining convenience, user experience, and business models. As APIs and Banking-as-a-Service (BaaS) platforms make these integrations faster and more scalable, the future of finance is becoming more invisible—and more powerful—within the apps people already use every day.

1. What Is Embedded Finance?

Embedded finance is the integration of financial tools and services within non-financial platforms. It allows users to access banking-like features—such as payments, credit, insurance, and investments—without leaving the app they’re using.

2. Payments Embedded into Apps

From food delivery to online shopping, embedded payment systems let users check out with a single click, often without realizing they’re interacting with a third-party payment processor. This creates a smooth and efficient checkout experience.

3. Buy Now, Pay Later (BNPL)

E-commerce platforms now offer BNPL at checkout, letting users split payments over time. This embedded lending feature increases sales conversion and gives consumers flexible payment options.

4. Embedded Lending

Retailers, gig platforms, and B2B marketplaces are embedding instant loan offerings into their apps. For example, drivers on a ride-sharing app can access short-term credit or early wage access without visiting a bank.

5. Insurance at the Point of Need

Embedded insurance is offered contextually—like adding travel insurance when booking a flight or device protection during electronics purchases. It simplifies the process and boosts coverage adoption rates.

6. Investment Features in Consumer Apps

Some platforms now offer micro-investing or stock trading features. For example, a shopping app might round up purchases and invest the spare change, helping users build wealth without extra effort.

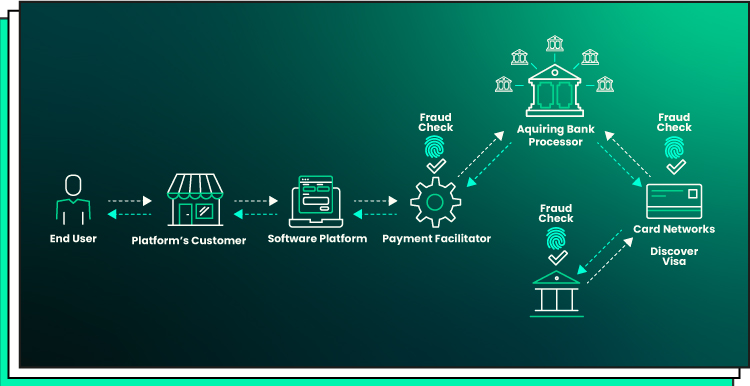

7. Banking-as-a-Service (BaaS) Platforms

BaaS providers enable embedded finance by offering APIs that plug financial products directly into non-financial apps. Companies can launch wallets, debit cards, or lending products without building full banking infrastructure.

8. Benefits for Businesses

Embedded finance drives customer engagement, increases revenue through value-added services, and improves user retention. It turns financial features into competitive differentiators for non-financial brands.

9. Benefits for Consumers

Consumers benefit from faster, more convenient access to financial services within the platforms they trust and use daily. It removes friction and often reduces the need for multiple apps or service providers.

10. The Future Outlook

As embedded finance evolves, expect deeper personalization, more sophisticated financial offerings, and broader access to underbanked populations. Regulation will play a key role in ensuring security and compliance.

Conclusion: Finance That Fits Everywhere

Embedded finance is not just a trend—it’s the new normal. It empowers any digital business to become a financial provider, creating a future where finance is less about standalone apps and more about being naturally woven into every digital interaction. As this model grows, users will experience financial services that are more accessible, intuitive, and built directly into the fabric of their digital lives.