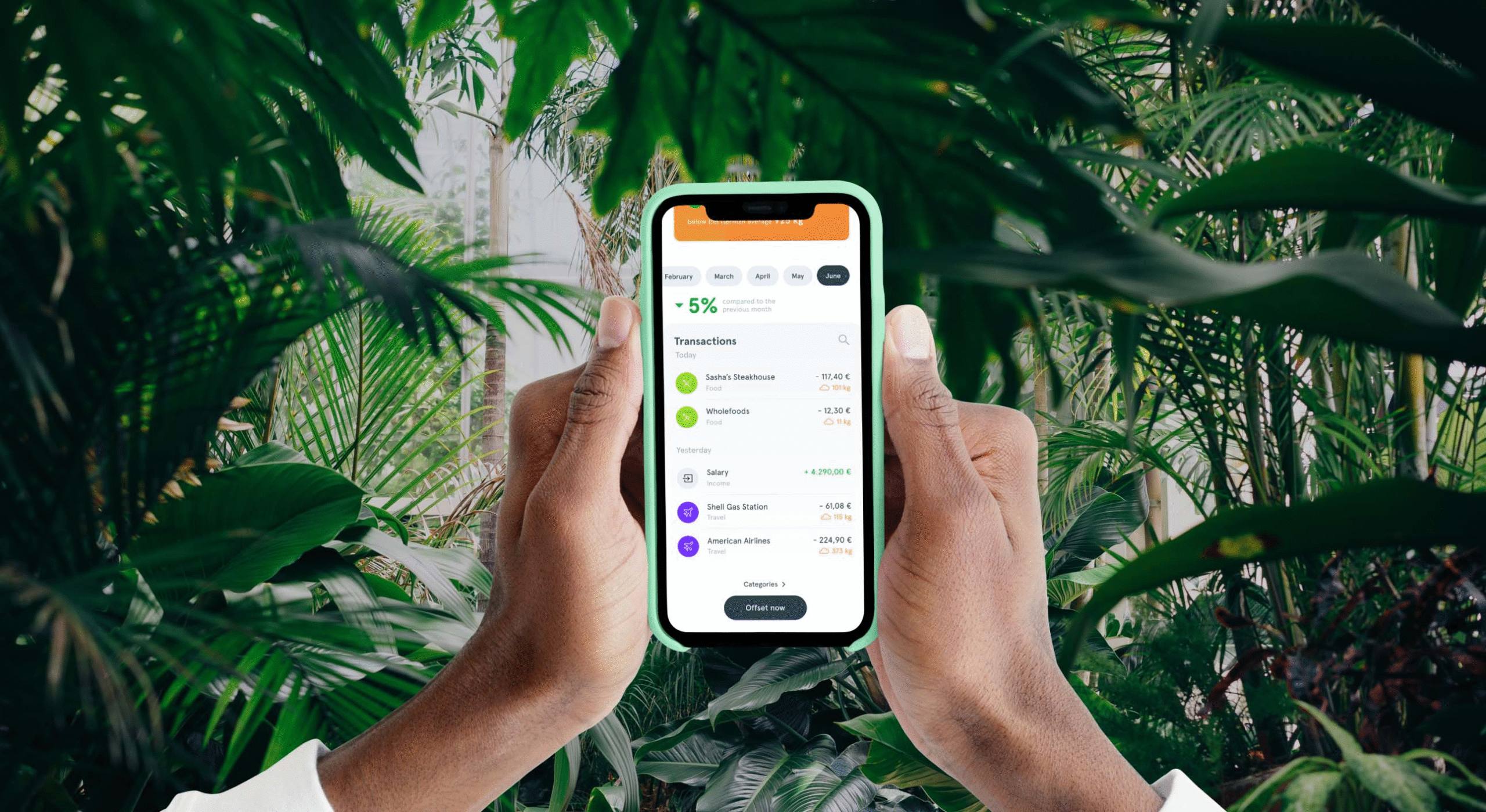

In 2025, a new breed of “green wallets” is helping consumers align everyday spending with environmental impact by automatically tracking the carbon footprint of each transaction. Built by fintech innovators and climate-conscious banks, these wallets integrate carbon analytics into payment systems, offering real-time feedback on how purchases—from flights to groceries—affect the planet. By leveraging AI, merchant-level emissions databases, and lifestyle profiling, green wallets break down individual spending into tangible climate metrics. Users can view personalized dashboards, set emissions-reduction goals, and even offset their footprint through vetted sustainability projects. As climate awareness surges among younger, values-driven consumers, green wallets are redefining personal finance—not just as a tool for managing money, but as a gateway to living more sustainably.

1. How Green Wallets Work

Green wallets analyze purchase data to calculate approximate carbon emissions for each transaction. This is enabled by:

- Merchant classification systems (e.g., MCC codes, product-level data)

- Carbon emissions databases matched to spending categories (e.g., kilograms of CO₂ per dollar spent)

- Machine learning models that learn user habits and refine estimates over time

- Integration with banks, neobanks, and credit card APIs for real-time tracking

Each time you spend—whether it’s on a burger, Uber ride, or a new jacket—you get a corresponding carbon estimate, helping you understand and manage your environmental footprint.

2. Gamified Tools for Climate-Conscious Consumers

Many green wallets now include:

- Visual dashboards showing daily/weekly/monthly emissions

- “Carbon budgets” to stay within personal environmental targets

- Spending nudges suggesting lower-impact alternatives (e.g., “This flight emits 230kg CO₂—train travel would cut it by 80%”)

- Offset integrations, allowing users to invest in reforestation, renewable energy, or carbon capture projects directly in-app

- Social features, like sharing carbon milestones or participating in eco challenges with friends or communities

This gamification makes climate action feel accessible, practical, and personal.

3. The Rise of Climate-Aware Banking

Green wallets are part of a broader movement toward climate-aware finance, where consumers increasingly ask:

- Where does my bank invest?

- Is my money funding fossil fuels or green energy?

- How can my spending align with sustainability goals?

Neobanks and fintechs are responding by embedding green features into checking accounts, savings tools, and even robo-advisors. Some are issuing eco debit cards made from recycled materials, while others route a portion of transaction fees into carbon-offset or rewilding initiatives.

4. Ethical, Technical, and Privacy Challenges

Despite their potential, green wallets face hurdles:

- Estimating emissions accurately at the individual transaction level is complex and approximate

- Consumer trust requires transparency about data sources and offset efficacy

- Privacy must be carefully protected, especially when wallets track detailed personal spending behavior

- Regulatory oversight is expected to increase, particularly around claims of sustainability and offset legitimacy

Leading platforms are addressing this with third-party audits, blockchain-based offset verification, and clear disclosures on impact methodology.

Conclusion

Green wallets represent a powerful fusion of personal finance and climate awareness—helping users turn spending into a force for environmental good. By giving consumers real-time insight into their carbon impact, these tools foster more mindful choices and provide actionable pathways to reduce and offset emissions. As sustainability becomes a defining feature of modern living, green wallets aren’t just financial tools—they’re everyday climate companions. In a world where every swipe matters, they make it easier to live—and spend—within planetary limits.