In 2025, zero-knowledge proofs (ZKPs) have emerged as a groundbreaking technology in blockchain finance, significantly enhancing privacy without sacrificing transparency or security. ZKPs allow one party to prove to another that a statement is true—such as the validity of a transaction or ownership of assets—without revealing any underlying data. This cryptographic innovation is enabling financial institutions, decentralized finance (DeFi) platforms, and regulators to maintain confidentiality of sensitive information while verifying compliance and preventing fraud. As blockchain networks increasingly handle complex financial activities, zero-knowledge proofs provide a vital solution to balance user privacy with the demands of trust and regulatory oversight in the digital economy.

1. What Are Zero-Knowledge Proofs?

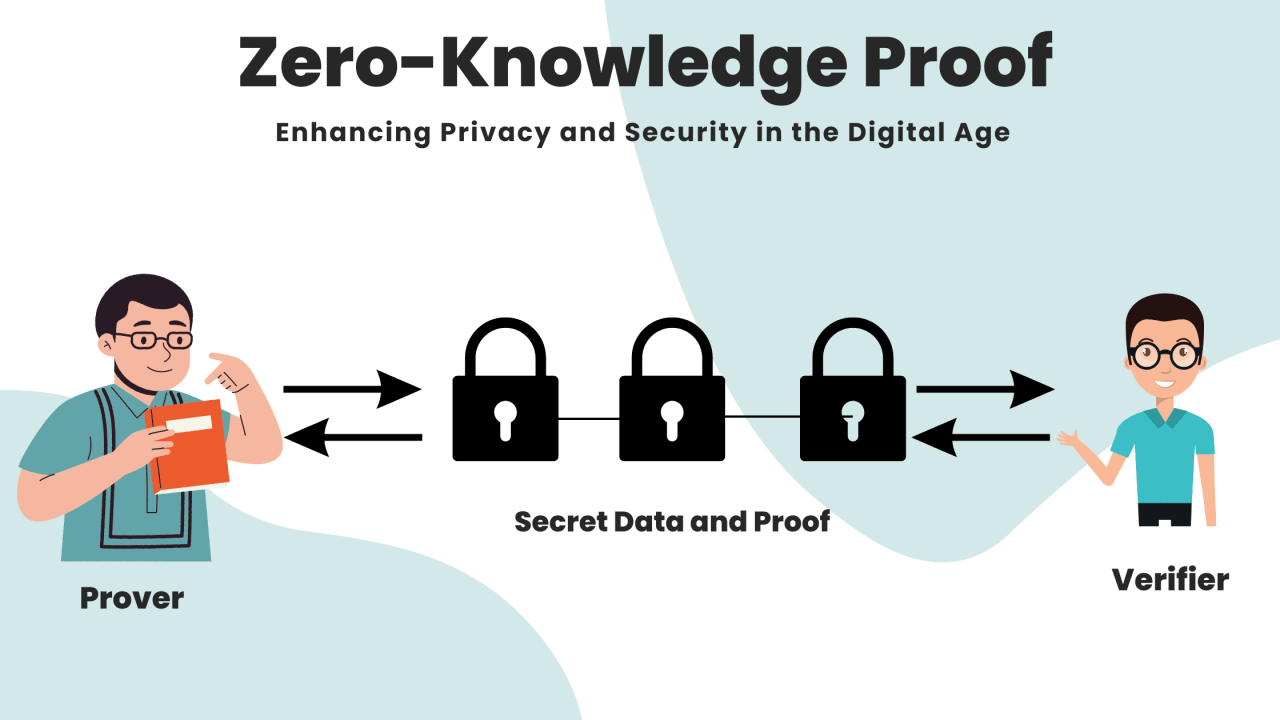

Zero-knowledge proofs are cryptographic protocols that allow verification of data without exposing the data itself. In blockchain finance, ZKPs enable:

- Verification of transaction validity without revealing sender, receiver, or amount

- Proving ownership or creditworthiness without disclosing full identity or financial history

- Confirming compliance with regulations while preserving data confidentiality

This technology supports privacy-preserving audits and confidential smart contracts.

2. Applications in Blockchain Finance

ZKPs are transforming multiple financial use cases, including:

- Confidential transactions on public blockchains, shielding amounts and parties involved

- Privacy-preserving identity verification in decentralized KYC/AML processes

- Secure multi-party computations for collaborative risk assessment or portfolio management

- Regulatory reporting that verifies compliance without disclosing proprietary data

These applications help bridge the gap between openness and confidentiality on blockchain platforms.

3. Benefits for Users and Institutions

For users, ZKPs protect financial privacy and reduce exposure to hacking or surveillance risks. For institutions, they:

- Enhance trust by enabling verifiable yet confidential transactions

- Reduce compliance burdens with automated, privacy-respecting proofs

- Foster wider adoption of DeFi by addressing privacy concerns that previously limited mainstream participation

The result is a more secure, efficient, and user-friendly blockchain financial ecosystem.

4. Challenges and Future Directions

Despite their promise, implementing ZKPs involves challenges such as:

- Computational complexity and scalability issues that require optimization

- The need for standardized protocols and interoperability across blockchains

- Regulatory acceptance and understanding of zero-knowledge technology

Ongoing research and development, combined with cross-industry collaboration, are driving improvements in speed, usability, and regulatory frameworks.

Conclusion

Zero-knowledge proofs represent a pivotal advancement in blockchain finance, enabling unprecedented levels of privacy while maintaining trust and regulatory compliance. By allowing data verification without exposure, ZKPs address one of the most significant barriers to blockchain adoption in financial services—privacy concerns. As technology matures, zero-knowledge proofs are set to underpin a new era of confidential, secure, and scalable blockchain finance, empowering users and institutions alike to transact with confidence in an increasingly digital world.