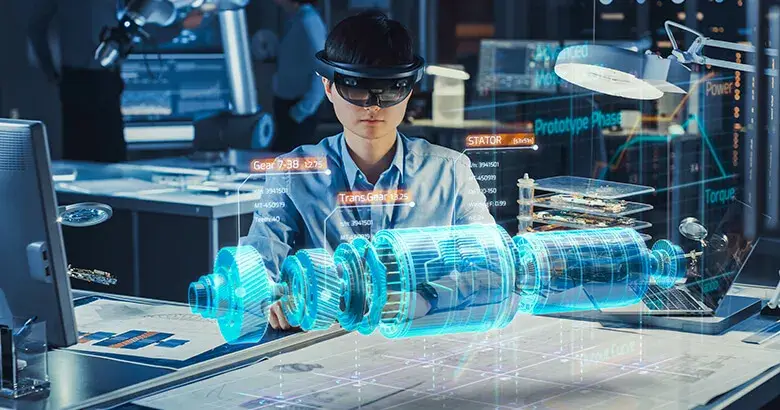

The Future of Wealth Tracking with Augmented Reality

As technology continues to redefine the way we interact with money, augmented reality (AR) is emerging as a futuristic and powerful tool in wealth tracking. By overlaying financial data onto…

Fintech’s Role in Automating Payroll for Remote Workforces

As remote work becomes a permanent fixture in the modern economy, fintech is playing a critical role in revolutionizing how companies manage payroll for globally distributed teams. Traditional payroll systems…

The Rise of Financial Super Apps: One Platform, Multiple Services

Financial super apps are rapidly becoming the future of personal finance, offering users a one-stop platform that combines banking, investing, payments, lending, budgeting, and even insurance—all in a single interface.…

Gamified Investing: Making Finance Fun and Accessible

Gamified investing is changing the face of personal finance by transforming what was once seen as a complex, intimidating world into an engaging, interactive, and accessible experience. Through the use…

Digital Twins in Finance: Mirroring Real-World Financial Health

The concept of digital twins—virtual replicas of physical systems—is expanding beyond manufacturing and engineering and making its way into the world of finance, where it offers a powerful way to…

The Tech Behind Instant Mortgage Approvals

What once took weeks of paperwork and waiting can now happen in minutes, thanks to the transformative technology behind instant mortgage approvals. Traditionally, applying for a mortgage involved complex documentation,…

How Predictive Finance is Shaping Smarter Spending Habits

Predictive finance is rapidly becoming a game-changer in personal money management by helping individuals make smarter spending decisions based on data-driven insights. Using technologies like artificial intelligence, machine learning, and…

The Silent Power of Fintech in Revolutionizing Charity Donations

Fintech is quietly transforming the world of charity donations, creating new avenues for giving that are faster, more transparent, and more accessible than ever before. Traditionally, donating to charities involved…

Tech Titans Enter Finance: What It Means for the Industry

The entry of tech giants such as Amazon, Google, Apple, and Facebook into the financial sector is reshaping the industry’s landscape in unprecedented ways. These companies bring vast technological expertise,…

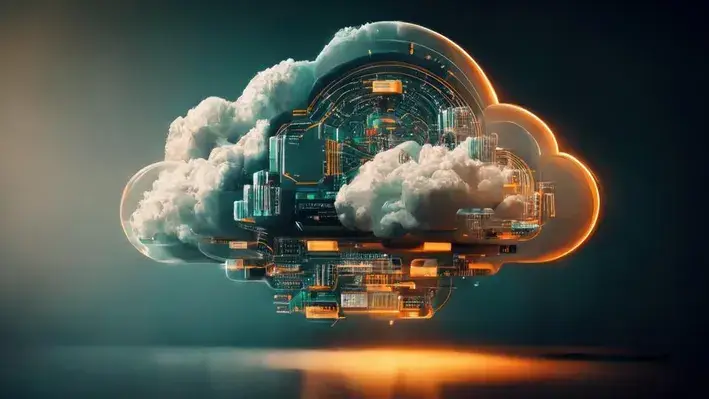

Cloud Finance: Moving Money to the Digital Sky

The rise of cloud computing is transforming the financial industry by moving money management and financial operations into the digital sky. Cloud finance refers to the use of cloud-based technologies…

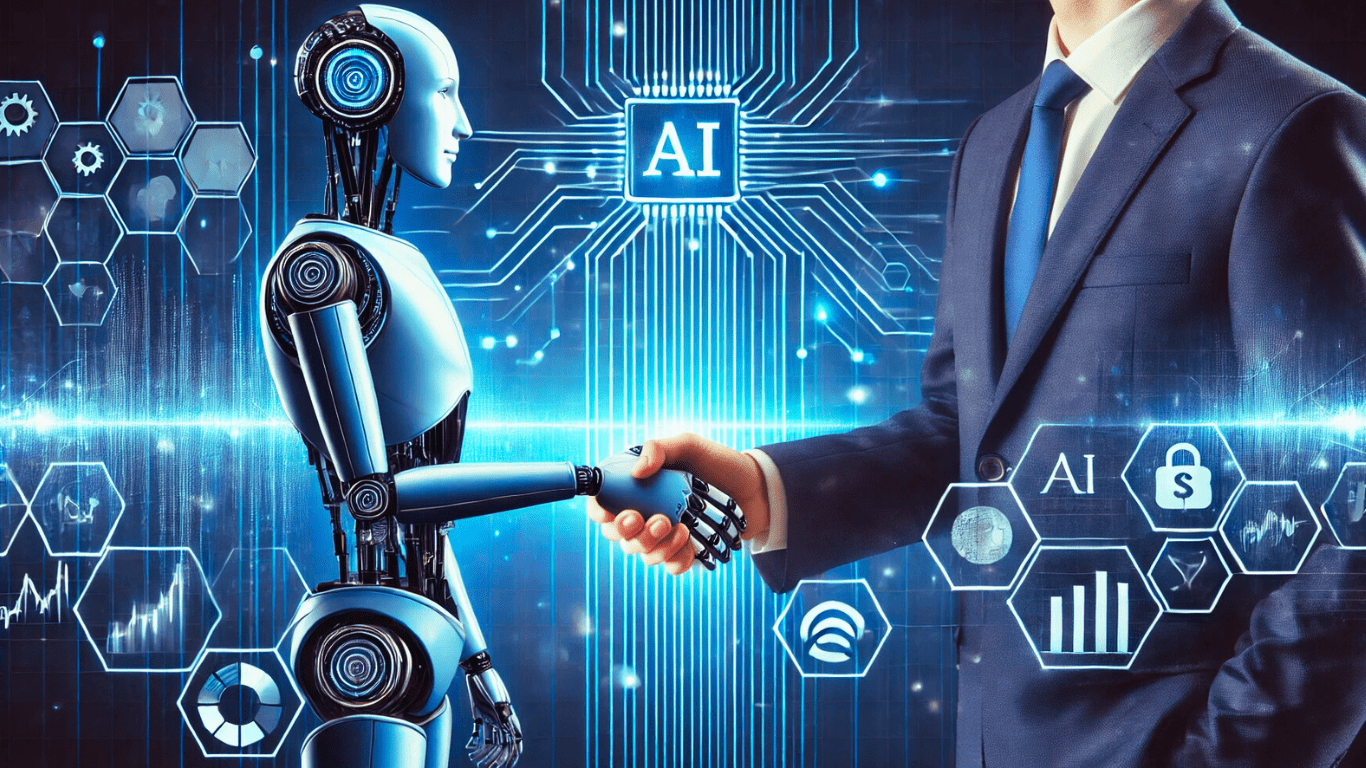

How AI is Transforming Banking and Financial Services

Artificial Intelligence (AI) is reshaping the global banking and financial services industry at a fundamental level. What was once the domain of human judgment, paperwork, and physical processes is now…

Top 10 Fintech Trends Revolutionizing Finance in 2025

The financial world is experiencing one of its most transformative periods in history. In 2025, fintech is not just a buzzword—it’s a catalyst driving innovation across the entire financial ecosystem.…

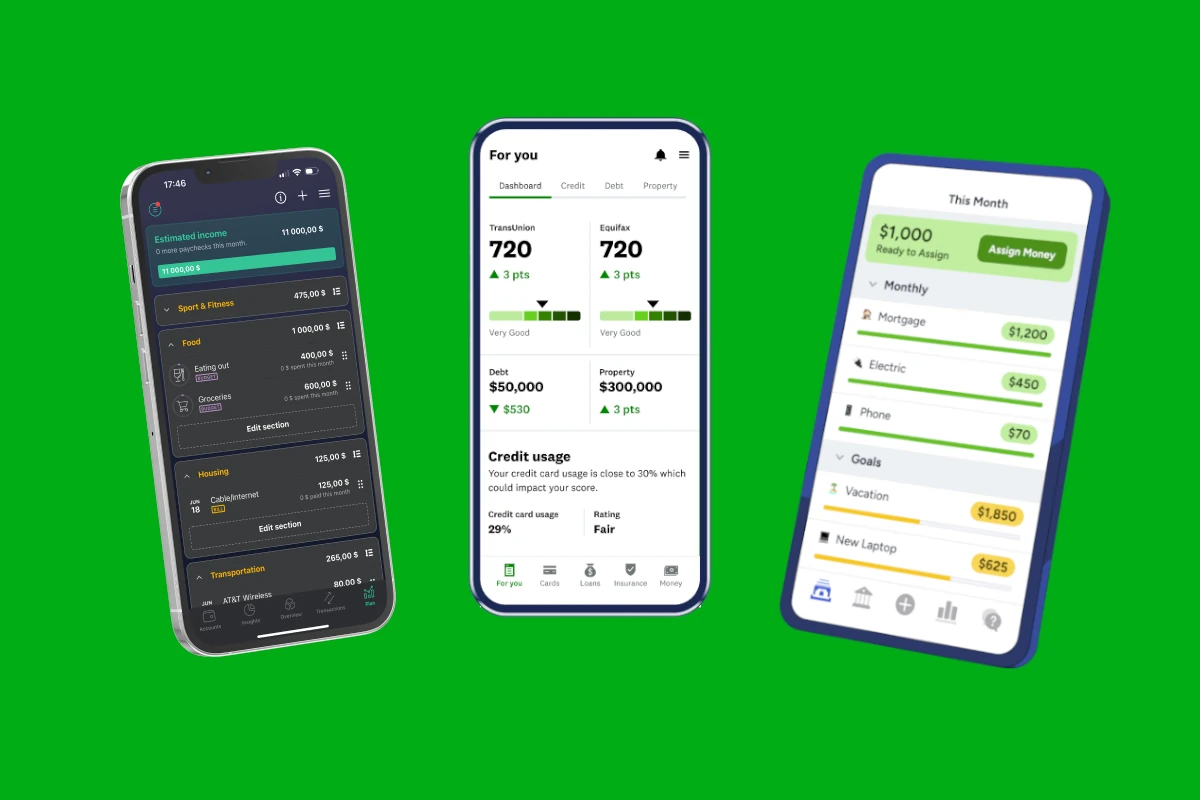

Best Personal Finance Apps of 2025: Reviewed & Ranked

In 2025, managing your money has never been easier—or smarter. Personal finance apps have evolved into powerful tools that not only help users track spending and save money, but also…

From Blockchain to CBDCs: What’s Next in Digital Finance?

Digital finance is evolving at lightning speed, and the journey from blockchain to Central Bank Digital Currencies (CBDCs) is only the beginning. Blockchain technology laid the groundwork by decentralizing financial…

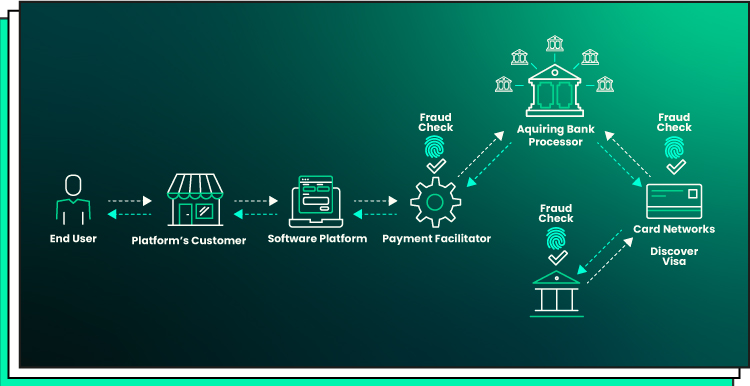

Embedded Finance Explained: The Future of Non-Banking Apps

Embedded finance is rapidly becoming one of the most transformative forces in fintech. At its core, embedded finance refers to the seamless integration of financial services—like payments, lending, insurance, or…

The Future of Payments: What Comes After Contactless?

Contactless payments have quickly become the global standard, offering speed, convenience, and safety during a time when hygiene and efficiency took center stage. But in a world where innovation never…

How Digital Wallets Are Outpacing Credit Cards in Usage

In recent years, digital wallets have surged ahead as the preferred payment method for consumers worldwide, increasingly outpacing traditional credit cards in everyday transactions. This shift is driven by the…

Buy Now, Pay Later (BNPL): Disruptor or Danger?

Buy Now, Pay Later (BNPL) has taken the retail and fintech worlds by storm, offering consumers the ability to purchase goods immediately and spread payments over time without the traditional…

How Fintech Apps Are Changing How Gen Z Manages Money

Gen Z, the generation born roughly between 1997 and 2012, is redefining personal finance with the help of fintech apps that cater to their digital-first lifestyles and unique financial challenges.…

Neobanks vs Traditional Banks: Who’s Winning in 2025?

The financial battlefield in 2025 is more competitive than ever as neobanks—digital-first, branchless banks—continue to challenge the dominance of traditional banking institutions. What began as a niche alternative for tech-savvy…

How KYC and AML Are Evolving with AI and Biometrics

Know Your Customer (KYC) and Anti-Money Laundering (AML) processes have long been critical pillars in the financial industry, aimed at preventing fraud, financial crimes, and ensuring regulatory compliance. However, traditional…

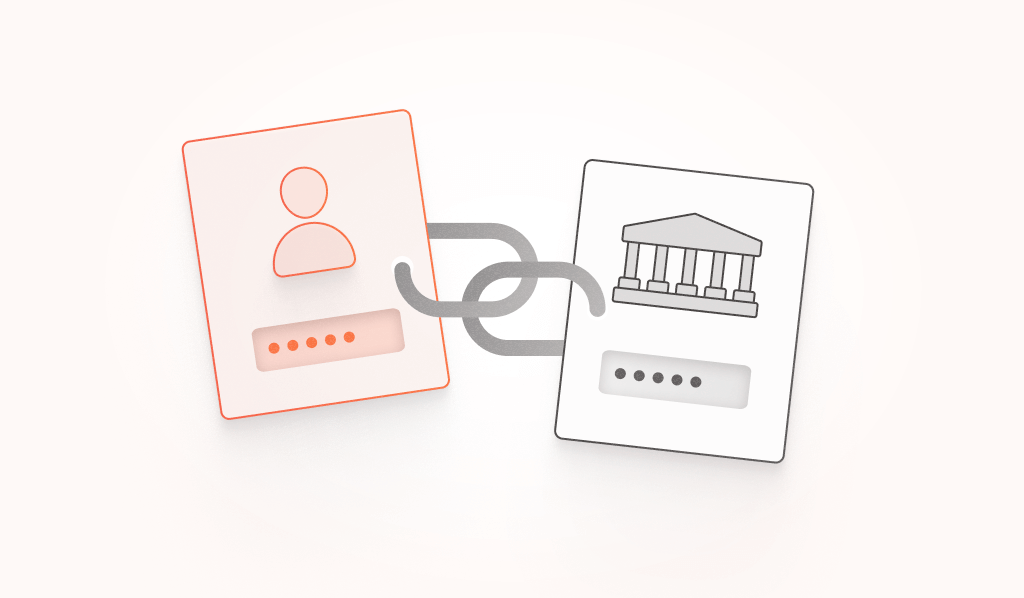

Open Banking in Practice: Benefits, Risks, and Real-World Use Cases

Open Banking is transforming the financial services landscape by enabling secure data sharing between banks and third-party providers through APIs (Application Programming Interfaces). This shift empowers consumers with greater control…

Cybersecurity in Fintech: 7 Strategies to Stay Safe

As fintech continues to revolutionize the financial services industry, the importance of cybersecurity has never been greater. Fintech platforms handle vast amounts of sensitive personal and financial data, making them…

The Rise of Green Fintech: Can Tech Drive Sustainable Investing?

As the climate crisis intensifies and global awareness of environmental issues grows, a new wave of financial technology—Green Fintech—is emerging to align capital flows with sustainability goals. Green fintech refers…

Tokenization of Assets: Real Estate, Stocks, and Beyond

The tokenization of assets is revolutionizing the way we invest, trade, and think about ownership. By converting physical and traditional financial assets—such as real estate, stocks, art, and even commodities—into…

Top 5 Crypto Fintech Startups to Watch in 2025

The crypto fintech landscape in 2025 is vibrant and rapidly evolving, with several startups making significant strides in innovation, regulation, and market adoption. These companies are not only redefining financial…

How Robo-Advisors Are Reshaping Wealth Management

Robo-advisors have revolutionized the wealth management industry by making sophisticated financial planning and investment services more accessible, affordable, and efficient than ever before. These digital platforms use algorithms and artificial…

DeFi vs Traditional Finance: Bridging the Regulatory Gap

Decentralized Finance (DeFi) has emerged as a powerful alternative to traditional finance, offering open, permissionless, and automated financial services powered by blockchain technology. Unlike traditional financial systems, which are heavily…

How Fintech Is Making Investing Accessible to Everyone

Investing was once seen as a privilege reserved for the wealthy and financially savvy—a complex world filled with barriers like high fees, account minimums, and limited access to professional advice.…

Beyond Banks: Exploring the Fintech Revolution

The world of finance is no longer limited to traditional banks with marble floors, long queues, and rigid processes. A powerful shift is underway—driven by the fintech revolution—that is taking…

Digital Dollars: The Rise of Financial Technology

The financial world is experiencing a digital revolution like never before, and at the heart of this transformation lies the rise of financial technology—better known as fintech. What began as…

Banking on the Future: How Tech is Transforming Finance

The financial industry is undergoing a rapid and profound transformation, driven by the relentless advancement of technology. From mobile banking and blockchain to artificial intelligence and biometric security, digital innovation…

Robo-Advisors & Real Returns: Investing with Algorithms

The investment world has undergone a dramatic shift in recent years, driven by the rise of robo-advisors—digital platforms that use algorithms and data to automate investment decisions. These tools are…

Decoding Fintech: Tools Reshaping Personal Finance

Fintech—short for financial technology—has rapidly emerged as a powerful force that is transforming the way individuals manage their money. No longer confined to spreadsheets, bank tellers, or traditional advisors, personal…

The Cashless Shift: Future of Payments in a Digital Age

The world is rapidly moving away from physical currency, embracing a new era of digital payments that promise speed, convenience, and global connectivity. This cashless shift is not just a…

Smart Money: How AI is Changing Financial Services

Artificial Intelligence (AI) is no longer a futuristic concept—it’s a transformative force actively reshaping the financial services industry. From personalized banking experiences to fraud detection, credit scoring, and algorithmic trading,…

Code Meets Capital: The Intersection of Finance and Technology

In today’s hyper-connected world, finance and technology are no longer separate spheres—they have fused into a dynamic partnership that is reshaping global economies. At the heart of this convergence lies…

Regtech: Where Compliance Meets Innovation

In the fast-evolving world of finance, regulatory technology—commonly known as regtech—is emerging as a vital bridge between compliance demands and innovative solutions. Financial institutions face increasingly complex regulatory landscapes, with…

Fintech for All: Financial Inclusion through Innovation

In recent years, fintech has emerged as a powerful catalyst for financial inclusion, breaking down long-standing barriers that have historically excluded millions from accessing basic financial services. Traditional banking systems…

Open Banking: Unlocking a New Era in Finance

Open Banking is revolutionizing the financial landscape by breaking down traditional barriers and fostering unprecedented collaboration between banks, fintech companies, and consumers. At its core, Open Banking allows third-party providers…