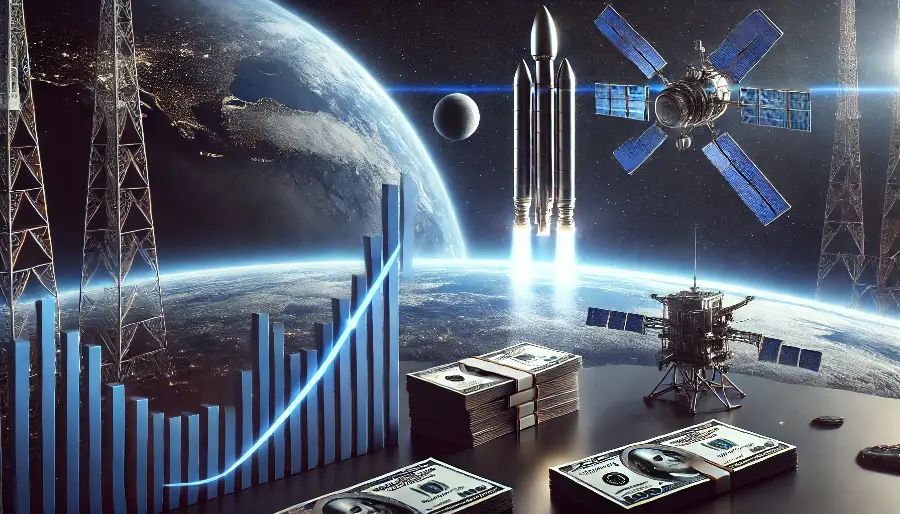

Fintech’s Role in Financing the Space Economy: Moonshot Investments

In 2025, fintech is playing an increasingly pivotal role in financing the fast-growing space economy—an emerging sector that spans satellite technology, space tourism, orbital logistics, and lunar exploration. With traditional…

How Digital Bartering Platforms Are Disrupting Traditional Finance

In 2025, digital bartering platforms are emerging as innovative disruptors to traditional finance by enabling direct exchange of goods and services without relying on conventional currency systems. These platforms leverage…

Next-Level Fraud Prevention: AI-Powered Threat Detection in Fintech

In 2025, AI-powered threat detection is transforming fraud prevention within fintech, providing sophisticated, real-time defenses against increasingly complex and evolving cyber threats. By leveraging advanced machine learning algorithms, behavioral analytics,…

Revolutionizing Payments: The Rise of Biometric Authentication in Fintech

In 2025, biometric authentication is revolutionizing the payments landscape within fintech, offering a secure, seamless, and user-friendly alternative to traditional password and PIN-based systems. Technologies such as fingerprint scanning, facial…

Open Finance APIs Drive Collaborative Innovation Among Fintechs

In 2025, Open Finance APIs have become a cornerstone for fintech innovation, enabling unprecedented levels of collaboration across the financial ecosystem. By providing secure, standardized access to financial data and…

Big Tech and Banks Forge New Alliances to Deliver Embedded Finance

In 2025, the collaboration between Big Tech companies and traditional banks is intensifying, creating powerful alliances aimed at delivering embedded finance solutions seamlessly integrated into everyday digital experiences. By combining…

Middle East Accelerates Fintech Innovation with Sovereign Wealth Support

In 2025, the Middle East is witnessing an unprecedented surge in fintech innovation, propelled largely by strategic investments and backing from sovereign wealth funds (SWFs). These government-owned investment vehicles are…

Digital Financial Inclusion Programs Gain Traction in Sub-Saharan Africa

In 2025, digital financial inclusion programs across Sub-Saharan Africa are rapidly expanding, driven by mobile technology, fintech innovation, and a growing focus on inclusive economic development. Millions of previously unbanked…

Latin America’s Crypto Adoption Surpasses Traditional Banking Use

In 2025, Latin America has reached a historic inflection point: for the first time, active use of cryptocurrencies has surpassed engagement with traditional banking services across several countries in the…

Fintech Cyber Insurance Market Expands Amid Rising Threats

In 2025, as cyberattacks against fintech platforms surge in frequency and sophistication, the cyber insurance market tailored specifically for fintech companies is experiencing rapid expansion. With the rise of digital…

Multi-Party Computation Redefines Data Sharing in Collaborative Banking

In 2025, Multi-Party Computation (MPC) is revolutionizing data sharing in collaborative banking environments by enabling multiple institutions to jointly analyze sensitive financial data without exposing underlying information to one another.…

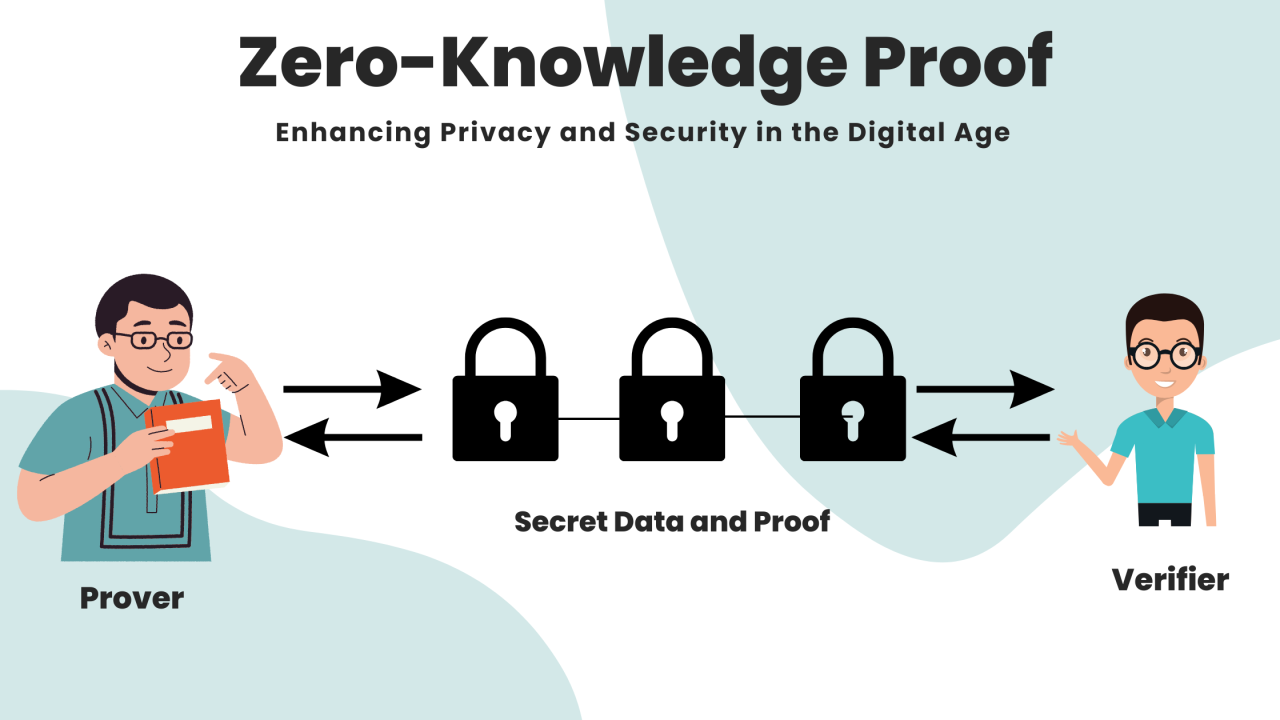

Zero-Knowledge Proofs Enhance Privacy in Blockchain Finance

In 2025, zero-knowledge proofs (ZKPs) have emerged as a groundbreaking technology in blockchain finance, significantly enhancing privacy without sacrificing transparency or security. ZKPs allow one party to prove to another…

Financial Data Marketplaces Emerge as the Next Big Fintech Asset

In 2025, financial data marketplaces are rapidly becoming a pivotal asset class within the fintech ecosystem, fundamentally reshaping how data is shared, monetized, and leveraged across industries. These marketplaces act…

Decentralized Identity Systems Promise to Revolutionize KYC Processes

In 2025, decentralized identity (DID) systems are poised to transform Know Your Customer (KYC) processes across the financial industry by enhancing security, privacy, and user control. Unlike traditional centralized identity…

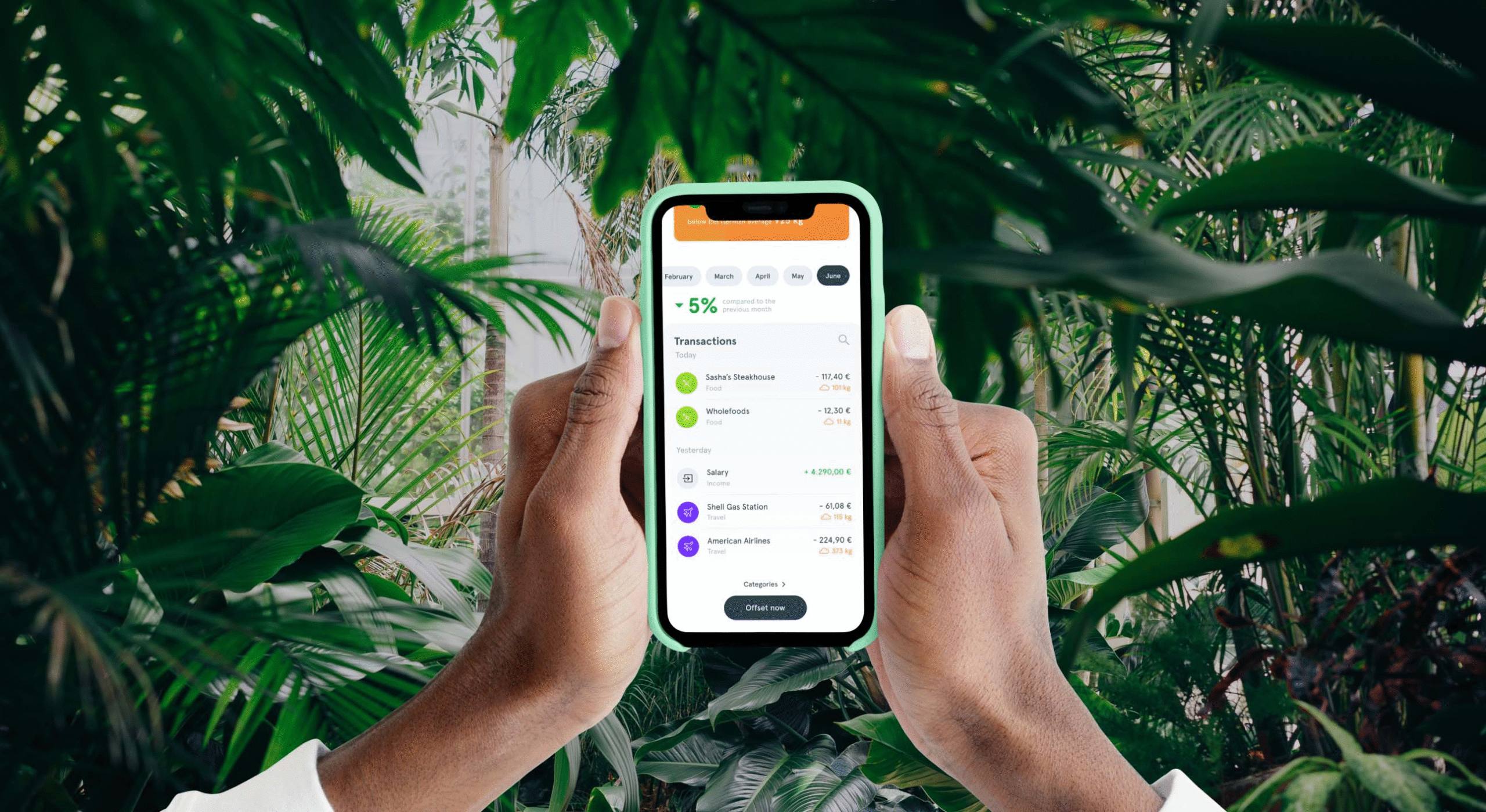

Green Wallets: Track Your Carbon Footprint with Every Transaction

In 2025, a new breed of “green wallets” is helping consumers align everyday spending with environmental impact by automatically tracking the carbon footprint of each transaction. Built by fintech innovators…

Fintech Startups Launch Climate Risk Dashboards for Retail Investors

In 2025, fintech startups are transforming how individual investors evaluate sustainability by launching climate risk dashboards tailored specifically for the retail market. These platforms provide intuitive, data-rich tools that visualize…

Small Business Lending Platforms Partner with POS Providers for Hyperlocal Financing

In 2025, a new wave of hyperlocal financing is reshaping small business credit access through strategic partnerships between digital lending platforms and point-of-sale (POS) providers. These integrations allow lenders to…

Buy Now, Pay Smarter: Interest-Free BNPL Linked to Behavioral Scoring

In 2025, Buy Now, Pay Later (BNPL) has evolved into a smarter, more responsible credit model—driven by interest-free plans that are dynamically linked to real-time behavioral scoring. Rather than relying…

Fintech Lenders Tap Alternative Data for Gen Z Credit Scoring

In 2025, fintech lenders are rapidly adopting alternative data strategies to assess the creditworthiness of Gen Z borrowers—who often lack traditional credit histories. By analyzing a broader range of digital…

AI-Driven Lending Platforms Offer Loans with Zero Human Touchpoint

In 2025, AI-driven lending platforms have reached full autonomy, offering personal and business loans without any human interaction—from application to approval, underwriting, and disbursement. These platforms use advanced artificial intelligence…

Offline Digital Wallets Drive Financial Access in Low-Connectivity Markets

In 2025, offline digital wallets are emerging as a game-changing solution in the global effort to close the financial inclusion gap. These wallets, which enable peer-to-peer payments, remittances, and basic…

Smart Routing Optimizes Cross-Border B2B Payments by 30%

In 2025, smart routing technologies have become a critical innovation in global finance, reducing the cost and complexity of cross-border B2B payments by as much as 30%. By leveraging artificial…

Invisible Payments Go Mainstream: Retail Adopts No-Touch Checkout at Scale

In 2025, invisible payments—also known as no-touch or frictionless checkout—have moved from early pilot programs into widespread adoption across global retail. Enabled by a fusion of technologies including computer vision,…

Embedded Compliance: RegTech Tools Now Built Directly into APIs

In 2025, the fusion of regulatory technology (RegTech) with embedded finance has reached a new milestone: compliance functions are now being seamlessly integrated directly into financial APIs. Known as “embedded…

Core Banking Goes Headless: Fintechs Embrace Modular Finance Stacks

In 2025, the banking industry is undergoing a foundational shift as fintechs and challenger banks move away from traditional monolithic core systems and adopt headless, modular finance stacks. In a…

Smart Contracts Power a New Breed of Automated Trade Finance Platforms

In 2025, smart contracts are revolutionizing the world of trade finance by enabling a new generation of automated, transparent, and efficient platforms that eliminate the long-standing bottlenecks of traditional systems.…

Banks Adopt AI Ops: 70% of Backend Processes Now Automated

In 2025, the global banking sector has reached a critical inflection point with over 70% of backend operations now fully automated through AI-driven operational systems, or “AI Ops.” These systems…

Robo-Advisors Use Generative AI for Hyper-Personalized Portfolios

In 2025, robo-advisors are entering a new era of sophistication as they integrate generative AI to offer hyper-personalized investment portfolios tailored to each individual’s unique financial goals, life events, and…

AI Wealth Advisors Manage Over $1 Trillion in Assets

As of mid-2025, artificial intelligence (AI)-powered wealth management platforms have collectively surpassed $1 trillion in assets under management (AUM), marking a significant milestone in the financial industry. These platforms, which…

SEC Approves First Bitcoin ETF for Retirement Accounts

In a landmark decision, the U.S. Securities and Exchange Commission (SEC) has approved the first Bitcoin Exchange-Traded Fund (ETF) specifically designed for inclusion in retirement accounts, including IRAs and 401(k)s.…

CBDCs Face Privacy Pushback Amid Central Bank Expansion

As central banks around the world accelerate the rollout of Central Bank Digital Currencies (CBDCs) in 2025, growing concerns about privacy and surveillance are triggering significant public and political pushback.…

Cybersecurity Threats Spike in Digital Wallet Ecosystems

In 2025, the rapid adoption of digital wallets has transformed how consumers and businesses conduct transactions, offering unparalleled convenience and speed. However, this explosive growth has also led to a…

Regulators Target Fintech Giants: New Compliance Mandates Arrive

As fintech giants continue to disrupt the financial services sector with innovative products and vast user bases, regulatory authorities worldwide are stepping up efforts to impose stricter compliance mandates in…

Embedded Finance Is the Future: Big Tech Firms Double Down

In 2025, embedded finance is rapidly becoming a cornerstone of the financial ecosystem as big tech firms intensify their efforts to integrate financial services directly into non-financial platforms. By embedding…

AI-Powered Credit Scoring Reshapes Lending Industry

In 2025, artificial intelligence (AI) is revolutionizing the lending industry by transforming traditional credit scoring models into dynamic, data-driven processes that offer greater accuracy, speed, and inclusivity. Conventional credit scoring…

Cross-Border Payments Get Faster with Blockchain Expansion

In 2025, the landscape of cross-border payments is witnessing a remarkable acceleration thanks to the widespread adoption and expansion of blockchain technology. Traditional international money transfers, often hindered by slow…

Fintech Startups Attract $12 Billion in Q2 Venture Capital

The fintech sector has once again captured investor attention, attracting a staggering $12 billion in venture capital funding in Q2 2025. This influx of capital underlines the sustained confidence in…

Digital Banking Booms: Neobanks Gain 40% Market Share in 2025

The global financial landscape in 2025 is undergoing a profound transformation as neobanks—digital-only financial institutions—surge to an unprecedented 40% market share. This remarkable growth is fueled by rapid technological advancements,…

We reveal the invisible mechanisms that move your money behind the scenes.

Modern money moves silently, efficiently, and often without a trace of friction—but that ease is powered by deeply complex systems. Behind every smooth tap, transfer, or investment is a hidden…

The story of your money’s journey through digital veins starts with us.

Your money travels farther and faster than ever before—but not on roads or through hands. It moves through digital veins: networks of code, platforms, processors, and protocols that form the…