The next financial revolution won’t be televised—it’ll be streamed here.

Financial revolutions used to unfold in the streets or on trading floors, captured in newsreels and breaking headlines. But today’s transformation is quieter, faster, and more technical. It’s happening in…

This is the news layer for the machines that move money.

The movement of money today is largely automated, executed not by human hands but by networks of machines—software, APIs, protocols, and algorithms working behind the scenes. From real-time payments and…

Finance has gone digital, decentralized, and redefined—we follow the shift.

The old boundaries of finance—physical branches, centralized control, delayed transactions—are dissolving. In their place is a new financial architecture that is digital-first, decentralized by design, and constantly evolving. This shift…

New rules are being written in code—we report them as they emerge.

The financial world is no longer governed solely by paper contracts, regulators, or legacy institutions. Today, a new set of rules is being crafted in lines of code—smart contracts, protocols,…

We cover the rise of smart systems in a world built on dumb money.

Money, in its traditional form, has long been static and inflexible—often described as “dumb money” because it simply moves, stores value, or pays debts without adaptability. But as finance enters…

The money you don’t see moves faster—this is where we explain how.

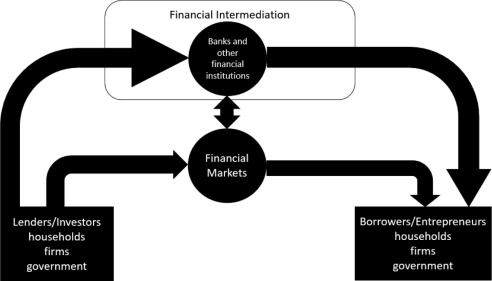

Much of the money that powers our economy moves behind the scenes, invisible to the everyday user but critical to global commerce. This hidden flow happens through sophisticated financial infrastructure—clearinghouses,…

Every tap, transfer, and token has a bigger story—this is where it unfolds.

Every time you tap your card, send money to a friend, or use a digital token, you’re engaging with an intricate system far beyond what meets the eye. These everyday…

FinTech isn’t a trend—it’s a transformation, and we’re on the ground.

FinTech isn’t some fleeting buzzword or passing fad—it’s a fundamental transformation reshaping the financial landscape at every level. From how money moves and how credit is accessed, to who controls…

Here’s where financial tools meet real-world impact, daily.

Behind every financial tool is a ripple effect felt far beyond screens and code. These tools — from mobile banking apps and payment processors to lending platforms and investment portals…

The infrastructure of money is changing—we document the shift.

Money has always needed a foundation—rails, networks, ledgers—that enable it to move, settle, and be trusted. But those foundations are no longer static; they are evolving rapidly under the pressure…

From back-end code to billion-dollar deals—we cover it all.

Finance today lives in two worlds at once: the quiet, technical backend where infrastructure is built line by line, and the high-stakes, high-visibility world of capital markets and mega-deals. Between…

This is the front page of finance that doesn’t look like yesterday’s.

Finance has a new look—and it’s not built from the usual headlines. The center of gravity has shifted from institutions to infrastructure, from Wall Street to codebases, from quarterly reports…

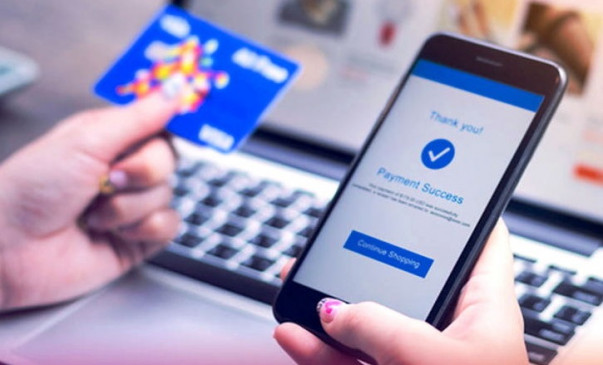

Behind every seamless payment is a story—we tell it.

You tap your phone, and the payment just works. It feels simple—frictionless, fast, forgettable. But behind that quiet moment is an enormous, invisible machine: layers of technology, regulation, security, partnerships,…

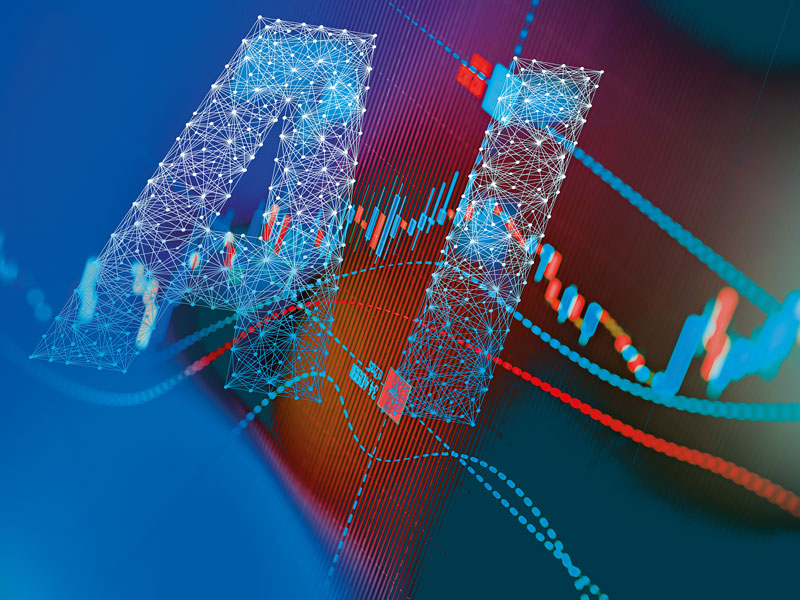

We write about what happens when financial systems learn to think.

Finance was once driven purely by human logic, manual oversight, and institutional memory. Today, it’s increasingly powered by systems that learn—constantly, silently, and at scale. Artificial intelligence, machine learning, and…

Every product, platform, and protocol changing money starts here.

The future of money doesn’t just arrive—it’s built. And every meaningful shift in finance today begins with a product, a platform, or a protocol that redefines what’s possible. Whether it’s…

We track the technology that’s quietly rebuilding global finance.

Beneath the headlines and away from trading floors, a quiet rebuild is underway—driven not by banks or governments alone, but by the technology reshaping every layer of global finance. Invisible…

The future of money doesn’t shout. It’s built in lines of code—we listen.

The next era of money isn’t arriving with grand declarations or political spectacle—it’s being written quietly, line by line, in code. Behind every sleek app, digital wallet, and stablecoin lies…

This is the pulse of digital finance—steady, sharp, and always moving.

Digital finance doesn’t pause. It hums beneath the surface—fast, constant, and precise—pushing value across borders, scanning risks in real time, and powering systems that respond to touch, tap, or code.…

Finance has gone quiet, seamless, fast. That’s the news now.

The most revolutionary changes in finance today aren’t loud—they’re quiet, seamless, and almost invisible. Payments settle in seconds without a second thought. Loans are approved with a few taps, and…

Invisible tech powers visible change—we reveal what’s underneath.

Much of the transformation reshaping finance today happens behind the scenes, powered by invisible technology that the average user never sees but deeply feels. Complex algorithms, cloud infrastructures, machine learning…

Where digital rails carry old money into new worlds, we follow.

The financial world is in the midst of a transformation, where traditional money journeys through new, digital rails—complex technological infrastructures that move funds faster, safer, and across borders like never…

Money doesn’t move like it used to. We explain why.

The way money moves today is fundamentally different from the past. Gone are the days when transactions required physical cash exchanges or long waits for bank transfers. Now, digital payments…

Every update in FinTech is a story of power—we bring them to light.

Every update in FinTech is more than just a software patch or feature release—it’s a shift in the balance of power within the financial ecosystem. From the launch of a…

While banks sleep, code rewrites their future—we don’t miss a line.

In the stillness of night, when traditional banks close their doors and the world seems to pause, an invisible revolution rages on inside data centers and cloud servers worldwide. Code—complex,…

Technology changed the rules of finance. We write about what comes next.

Technology changed the rules of finance. We write about what comes next. The way money moves, grows, and is managed today is no longer confined to traditional banks or outdated…

From silent algorithms to loud headlines—we track what shapes your wallet.

From silent algorithms to loud headlines—we track what shapes your wallet. Behind every financial headline, there’s a complex network of software, data, and decision-making models operating quietly in the background,…

If finance has a software layer, we’re reporting from it.

If finance has a software layer, we’re reporting from it. In today’s world, money doesn’t just flow through banks and ledgers—it flows through code, APIs, algorithms, and digital platforms. This…

The systems that move money are changing. We’re watching them closely.

The systems that move money are changing. We’re watching them closely. From the rise of digital wallets and instant payments to the explosion of decentralized finance and programmable money, the…

Not just finance. Not just tech. Everything in between, explained.

Not just finance. Not just tech. Everything in between, explained. In today’s world, finance and technology aren’t separate—they’re increasingly indistinguishable. But there’s a massive gap between how they’re built and…

Every transaction has a technology—this is where you learn about both.

Behind every transaction—whether it’s a tap at the checkout counter, a bank transfer, a crypto swap, or a click on a digital ad—there’s a system quietly powering the moment. Invisible…

We tell the real stories behind the numbers and the code.

We tell the real stories behind the numbers and the code, because data alone isn’t enough—it’s the human context, the challenges, and the breakthroughs that bring those digits to life.…

How Technology Is Transforming Finance Into a Seamless Digital Experience

Technology is revolutionizing finance, turning what was once a complex and often frustrating process into a seamless digital experience that fits effortlessly into our daily lives. From mobile banking apps…

Money Has Entered the Chat: The Social Side of Financial Technology

Money has entered the chat, quite literally. The rise of social finance—where financial tools and conversations blend seamlessly into social platforms—is redefining how we think about money, community, and influence.…

What Happens When Finance Becomes Frictionless?

When finance becomes frictionless, the barriers that once slowed down or complicated financial interactions disappear, unlocking a world where money moves as effortlessly as information. Friction in finance—whether it’s delays…

APIs, Apps, and Assets: How Digital Infrastructure Is Powering the New Economy

The new economy isn’t just built on traditional capital or labor—it’s powered by digital infrastructure that connects people, businesses, and markets at unprecedented speed and scale. At the heart of…

The End of Old Money: Why the Future of Finance Is Written in Code

The age of old money—rooted in brick-and-mortar banks, paper contracts, and manual ledgers—is rapidly drawing to a close. Today’s financial revolution is being driven not by traditional institutions, but by…

From Spreadsheets to Smart Contracts: The Evolution of Financial Intelligence

Finance has come a long way from the days of manual spreadsheets and ledger books, evolving into a sophisticated ecosystem powered by intelligent software and automated protocols. The shift from…

Not Just Money: How Technology Is Redefining What We Value

Money has long been humanity’s primary measure of value, a universal language for exchange and success. But in today’s rapidly evolving technological landscape, value itself is being redefined beyond mere…

When Finance Stops Being Boring: The Real Stories Behind Fintech Disruption

For decades, finance was the classic “boring” industry—dominated by suits, slow processes, and jargon-heavy reports that few outside the sector cared to understand. But fintech disruption has flipped that script…

Building the Digital Bank of Tomorrow, One Line of Code at a Time

In the age of digital transformation, banks are no longer just financial institutions—they are technology companies, crafting the future of money one line of code at a time. Building the…

The Intersection of IoT and FinTech: New Financial Possibilities

The Intersection of IoT and FinTech: New Financial Possibilities FinTech’s Influence on Corporate Treasury Optimization

FinTech’s Influence on Corporate Treasury Optimization The New Age of Financial Collaboration: FinTech Ecosystems

The New Age of Financial Collaboration: FinTech Ecosystems Why FinTech Should Be at the Heart of Your Digital Strategy

Why FinTech Should Be at the Heart of Your Digital Strategy The Impact of FinTech on Financial Data Transparency

The Impact of FinTech on Financial Data Transparency Transforming Wealth Management with FinTech Innovations

Transforming Wealth Management with FinTech Innovations Unlocking Liquidity with FinTech in Corporate Markets

Unlocking Liquidity with FinTech in Corporate Markets How FinTech is Accelerating Regulatory Compliance for Firms

How FinTech is Accelerating Regulatory Compliance for Firms The Rise of Decentralized Finance (DeFi) in Corporate Finance

The Rise of Decentralized Finance (DeFi) in Corporate Finance Leveraging Big Data to Drive Financial Strategy with FinTech

Leveraging Big Data to Drive Financial Strategy with FinTech Decoding Fintech: Tools Reshaping Personal Finance

Decoding Fintech: Tools Reshaping Personal Finance The Cashless Shift: Future of Payments in a Digital Age

The Cashless Shift: Future of Payments in a Digital Age Beyond Banks: Exploring the Fintech Revolution

Beyond Banks: Exploring the Fintech Revolution