What Fintech Can Teach Us About Building Financial Systems for the Future

For centuries, financial systems have been built on rigid foundations—centralized institutions, legacy infrastructure, and policies designed for slower economies. But the rise of fintech has challenged these norms. Agile, digital,…

When money meets technology, the rules shift—our job is to explain how.

The meeting point of money and technology is not just a collision—it’s a transformation. Every time code replaces a contract, or a smart wallet replaces a teller, the rules change.…

How Fintech Is Making Wealth Management More Accessible to All

Wealth management has traditionally been an exclusive service reserved for the affluent and institutional investors. High fees, complex products, and opaque advice often kept everyday people at arm’s length. But…

Why Fintech Adoption Is Accelerating Faster Than Industry Experts Predicted

Just a few years ago, fintech was still considered a promising but niche segment of the financial world. Experts predicted steady growth over time, especially among digital natives. But what…

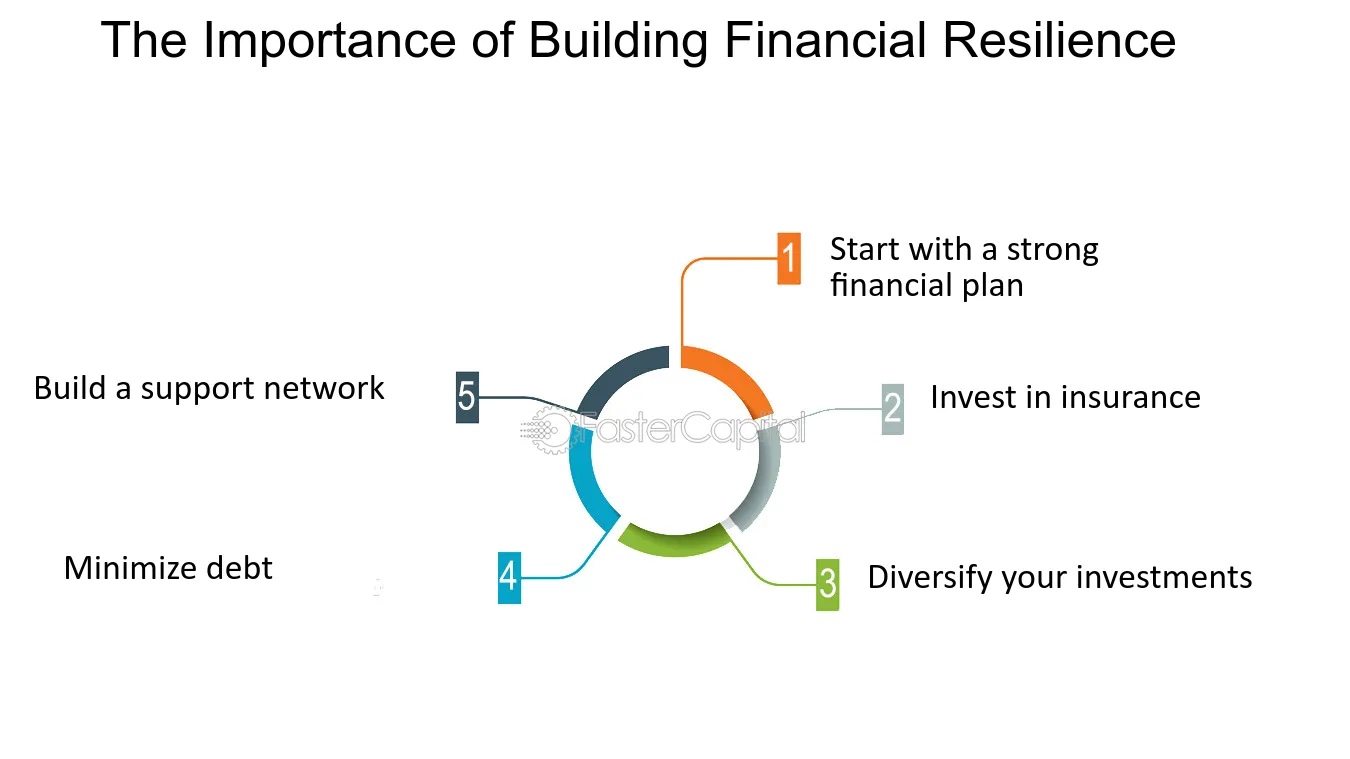

The Role of Fintech in Creating Financial Resilience During Global Crises

Global crises—whether economic downturns, pandemics, climate disasters, or geopolitical shocks—have a way of exposing the weaknesses in traditional financial systems. Access to funds dries up, small businesses collapse, and vulnerable…

How Fintech Innovations Are Changing the Way We Think About Insurance

Insurance has long been seen as a slow-moving industry—complex, opaque, and largely reactive. But fintech is rapidly changing that perception. By applying digital tools, data analytics, and customer-first thinking, fintech…

Why Decentralized Finance and Traditional Fintech Are Starting to Collaborate

For years, decentralized finance (DeFi) and traditional fintech seemed destined to follow different paths. DeFi, powered by blockchain and smart contracts, was built on ideals of transparency, autonomy, and disruption.…

How Fintech Is Shaping the Future of Cross-Border Payments and Remittances

Cross-border payments and remittances have long been plagued by slow transfer times, high fees, and lack of transparency. For decades, sending money internationally meant navigating complex banking systems, relying on…

What You Didn’t Know About Fintech’s Influence on Everyday Spending

When people hear the word “fintech,” they often think of flashy apps, cryptocurrency, or high-level banking innovation. But in reality, fintech’s influence is far more subtle—and far more personal. It’s…

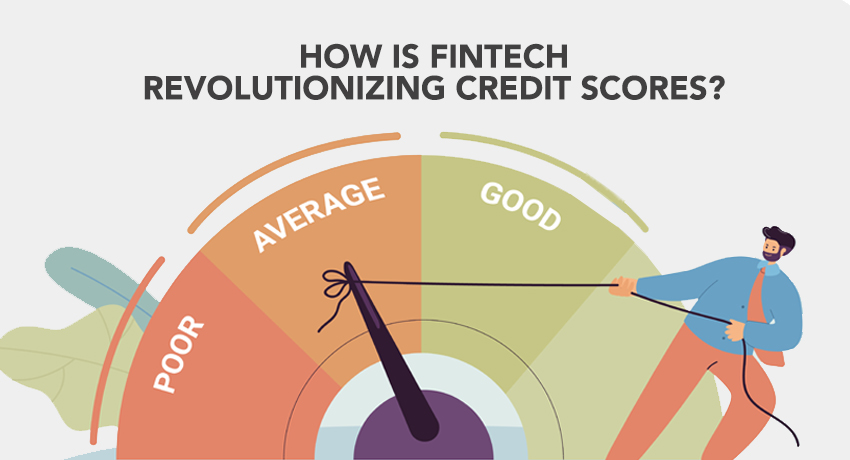

How Fintech Is Reimagining Credit Scoring for a Digital Generation

For decades, credit scoring has relied on outdated models: fixed formulas, traditional banking relationships, and narrow definitions of financial responsibility. These legacy systems have excluded millions—especially young people, freelancers, immigrants,…

Why Fintech Could Be the Secret Weapon for Emerging Economies

Emerging economies are often defined by dual realities: fast-growing populations full of entrepreneurial energy, and financial systems that lag in access, efficiency, or inclusiveness. But that gap presents an enormous…

What Happens When Fintech Meets the Metaverse: A New Financial Frontier

The future of finance is no longer just digital—it’s immersive. As the metaverse takes shape, blending virtual reality, decentralized platforms, and persistent digital environments, a new frontier is emerging where…

How Fintech Is Bridging the Gap Between Technology and Financial Trust

For decades, financial trust was built on familiar institutions—brick-and-mortar banks, face-to-face interactions, and long-standing reputations. But as technology transformed the financial industry, many wondered: Can digital platforms earn the same…

Why Fintech’s Role in Climate Finance Could Be Its Biggest Legacy Yet

As the urgency to address climate change intensifies, the financial sector is rapidly evolving to support a greener, more sustainable future. At the heart of this transformation lies fintech—an unexpected…

How Fintech Is Turning Traditional Banking Upside Down in 2025

The year 2025 marks a pivotal moment in the evolution of finance. Fintech, once seen as a challenger to traditional banking, has now become a transformative force rewriting the rules…

The Unexpected Ways Fintech Is Empowering Financial Freedom Worldwide

When people think about fintech, they often picture convenient apps for payments or budgeting. But beneath the surface, fintech is quietly revolutionizing financial freedom on a global scale—empowering millions in…

Why Fintech’s Most Impactful Innovations Are Still Under the Radar

Fintech has become a household term, with flashy payment apps and digital wallets grabbing the spotlight. Yet, the most transformative fintech innovations—the ones fundamentally reshaping financial services and economies—often fly…

How Fintech Is Quietly Rewriting the Rules of Global Finance Today

In the background of the financial world’s bustling activity, fintech is quietly but profoundly reshaping the rules that have governed global finance for decades. Far beyond flashy payment apps or…

Fintech Innovations Are Driving a Financial Revolution You Didn’t See Coming

When most people think of fintech, they imagine convenient payment apps or quick online loans. But the reality is much bigger—and much more transformative. Fintech innovations are sparking a financial…

Fintech Adoption Just Hit a Milestone—Here’s What That Means for You

In recent years, fintech has evolved from a niche innovation to a mainstream financial force, fundamentally reshaping how people around the world manage money. And now, fintech adoption has officially…

The Line Between Tech and Finance Is Blurring Faster Than Ever

In today’s world, the divide between technology and finance is dissolving at an unprecedented pace. What used to be two distinct industries—one focused on money, the other on software—are now…

Fintech Firms Are Teaming Up with Banks, and It’s Changing Everything

For years, fintech startups and traditional banks were seen as rivals locked in a battle for the future of finance. Banks were often slow-moving giants weighed down by legacy systems,…

If You Think Fintech Is Just About Payments, Think Again

When most people hear “fintech,” their minds jump immediately to digital wallets, contactless payments, or peer-to-peer money transfers. While payments are undeniably a huge part of fintech’s explosive growth, limiting…

Why 2025 Could Be the Breakout Year for Fintech in Emerging Markets

Fintech has already revolutionized how we send, save, borrow, and invest—but in 2025, the most dramatic transformation won’t happen in New York, London, or Singapore. It’s unfolding in emerging markets—from…

This New Wave of Fintech Startups Is Targeting What Banks Missed

Banks have been the backbone of global finance for centuries—but they haven’t always been agile. In their scale, legacy systems, and risk-averse nature, banks often overlook entire segments of the…

Here’s How Financial Technology Is Quietly Disrupting Global Markets

The disruption isn’t always loud. It doesn’t always come with a headline or a viral tweet. But financial technology (fintech) is steadily, methodically, and often invisibly reshaping the global economy—and…

Your Money, Your Code: The Future of Programmable Finance

In the not-so-distant past, money was passive—stored in banks, counted in ledgers, and moved only when told to. But in 2025, money is becoming programmable—a living, responsive layer of code…

Banking Without Banks: The Rise of Embedded Finance in 2025

A quiet revolution is underway—one that’s changing how we interact with money, often without us realizing it. In 2025, you don’t need to walk into a bank to open an…

Fintech Just Took Another Leap Forward, and You Might Have Missed It

While the world’s attention has been fixed on AI breakthroughs, space tourism, and political shifts, something major just happened in the world of finance—and most people didn’t even notice. Fintech…

Digital Wallets Are Winning the Payment Wars—Here’s Why

The battle for dominance in the payments landscape has been quietly raging for years—but make no mistake: digital wallets are winning. Whether it’s Apple Pay at the checkout counter, Google…

Fintech Isn’t Slowing Down, and the Numbers Prove It

The financial technology (fintech) industry has entered a new era of growth—swift, sustainable, and stronger than ever. Despite economic uncertainties, fintech is not just staying afloat—it’s rapidly scaling, transforming traditional…

Inside the APIs and Algorithms That Are Changing Wall Street

Wall Street, the historic hub of global finance, is being fundamentally transformed by cutting-edge technology—specifically APIs (Application Programming Interfaces) and algorithms. Together, these innovations are driving unprecedented speed, efficiency, and…

Exploring the Rise of Neobanks and the End of Physical Banking

The banking industry is undergoing a seismic shift as neobanks—digital-first, branchless banks—emerge as powerful challengers to traditional banks with physical branches. This shift raises the question: Is the era of…

FinTech vs. Traditional Banks: Who’s Winning the Future of Finance?

The financial landscape is rapidly evolving, with FinTech startups and traditional banks competing—and collaborating—to define the future of finance. But who’s really winning this race, and what does the future…

From Mobile Payments to AI-Driven Investing: The FinTech Story So Far

The financial technology (FinTech) sector has revolutionized how individuals and businesses manage money, access services, and invest. Its journey from simple digital payment solutions to complex AI-driven investment tools marks…

Democratizing Finance: The Role of FinTech in Global Inclusion

Financial technology (FinTech) is revolutionizing the global financial landscape by providing inclusive, accessible, and affordable financial services to underserved populations. Leveraging digital platforms, mobile solutions, and innovative business models, FinTech…

How AI is Quietly Rewriting the Rules of Personal Finance

We are living through one of the most radical shifts in financial behavior in human history—and it’s happening quietly, subtly, almost invisibly. Artificial intelligence isn’t shouting about its presence in…

How FinTech Empowers People to Control Their Financial Future

Financial technology (FinTech) is revolutionizing personal finance by providing individuals with the tools and knowledge to take control of their financial destinies. From enhancing financial literacy to offering personalized financial…

The FinTech Transformation: Smarter, Faster, Borderless Finance

The financial services industry is undergoing a profound transformation, driven by technological advancements that are making finance smarter, faster, and more borderless. From artificial intelligence to blockchain, these innovations are…

Behind the Code: The Systems Powering the FinTech Boom

The FinTech revolution is not just about innovative apps and user-friendly interfaces; it’s underpinned by a robust and sophisticated technological infrastructure. From cloud computing to artificial intelligence, these systems enable…

The Intersection of IoT and FinTech: New Financial Possibilities

The Intersection of IoT and FinTech: New Financial Possibilities FinTech’s Influence on Corporate Treasury Optimization

FinTech’s Influence on Corporate Treasury Optimization The New Age of Financial Collaboration: FinTech Ecosystems

The New Age of Financial Collaboration: FinTech Ecosystems Why FinTech Should Be at the Heart of Your Digital Strategy

Why FinTech Should Be at the Heart of Your Digital Strategy The Impact of FinTech on Financial Data Transparency

The Impact of FinTech on Financial Data Transparency Transforming Wealth Management with FinTech Innovations

Transforming Wealth Management with FinTech Innovations Unlocking Liquidity with FinTech in Corporate Markets

Unlocking Liquidity with FinTech in Corporate Markets How FinTech is Accelerating Regulatory Compliance for Firms

How FinTech is Accelerating Regulatory Compliance for Firms The Rise of Decentralized Finance (DeFi) in Corporate Finance

The Rise of Decentralized Finance (DeFi) in Corporate Finance Leveraging Big Data to Drive Financial Strategy with FinTech

Leveraging Big Data to Drive Financial Strategy with FinTech Decoding Fintech: Tools Reshaping Personal Finance

Decoding Fintech: Tools Reshaping Personal Finance The Cashless Shift: Future of Payments in a Digital Age

The Cashless Shift: Future of Payments in a Digital Age Beyond Banks: Exploring the Fintech Revolution

Beyond Banks: Exploring the Fintech Revolution