What Happens When Finance Meets Disruptive Technology

The fusion of finance and disruptive technology is reshaping the global economic landscape. Innovations such as blockchain, artificial intelligence (AI), and decentralized finance (DeFi) are not merely enhancing existing financial…

Unlocking Financial Access in a Cashless World

The global transition towards a cashless society is not merely a technological shift; it’s a profound transformation in how we perceive and interact with money. As digital payments become ubiquitous,…

The Wallet Is Now a Widget: Inside the Rise of Embedded Finance

The traditional wallet—once a bulky leather accessory holding cash, cards, and receipts—is undergoing a radical transformation. Today, it’s no longer a physical object but a digital widget embedded seamlessly inside…

The Digital Revolution That’s Changing How We Think About Money

Money, once a tangible and straightforward concept, is undergoing a profound transformation. The digital revolution is not just altering how we spend, save, and invest—it’s reshaping our very understanding of…

Why the Next Generation of Banking Is Built on Code

The banking industry is undergoing a profound transformation. Traditional banking systems, often built on decades-old infrastructure, are being replaced by modern, code-driven platforms that offer greater agility, scalability, and innovation.…

From Banks to Blockchain: The Evolution of Financial Technology

The financial services industry has undergone a remarkable transformation over the past few decades. From the establishment of traditional banks to the rise of digital currencies and decentralized finance, technology…

How FinTech Is Reshaping the Way the World Moves Money

The financial landscape is evolving at an unprecedented pace, and FinTech (financial technology) sits at the heart of this revolution. From peer-to-peer payments to instant cross-border transfers, FinTech innovations are…

Reimagining the Future of Finance Through Technology

The finance industry is in the midst of a remarkable transformation. Powered by rapid technological advancements, the way we interact with money is evolving faster than ever. Gone are the…

Unlocking Financial Agility: How FinTech is Simplifying Complex Business Transactions

In today’s fast-paced business environment, agility is king. Organizations are constantly seeking ways to accelerate processes, reduce friction, and improve transparency in their financial operations. Complex business transactions—such as cross-border…

Redefining Corporate Finance with Next-Gen FinTech Innovations

The corporate finance landscape is undergoing a profound transformation, driven by the rapid emergence of next-generation FinTech innovations. Traditional processes, often characterized by manual workflows, legacy systems, and slow decision-making,…

The Silent Revolution: How FinTech is Streamlining Back-Office Finance

While front-end innovations in finance—like mobile payments and digital wallets—often grab headlines, a quieter but equally transformative revolution is underway in the back-office. FinTech is fundamentally reshaping back-office finance operations,…

Bridging the Gap: FinTech Solutions for Complex Financial Workflows

In today’s rapidly evolving financial landscape, organizations face increasingly complex workflows that require agility, precision, and speed. Traditional manual processes and siloed systems struggle to keep up with growing demands—leading…

How Smart Contracts Are Reshaping Financial Agreements

In an industry built on trust, accuracy, and time-sensitive execution, the traditional financial agreement has long been due for a digital makeover. Enter smart contracts—self-executing agreements powered by blockchain technology…

How FinTech is Shaping the Future of Payroll and HR Finance

FinTech is reshaping the future of payroll and HR finance by automating outdated processes, improving employee financial wellness, and increasing operational efficiency for businesses. Traditional payroll systems often suffer from…

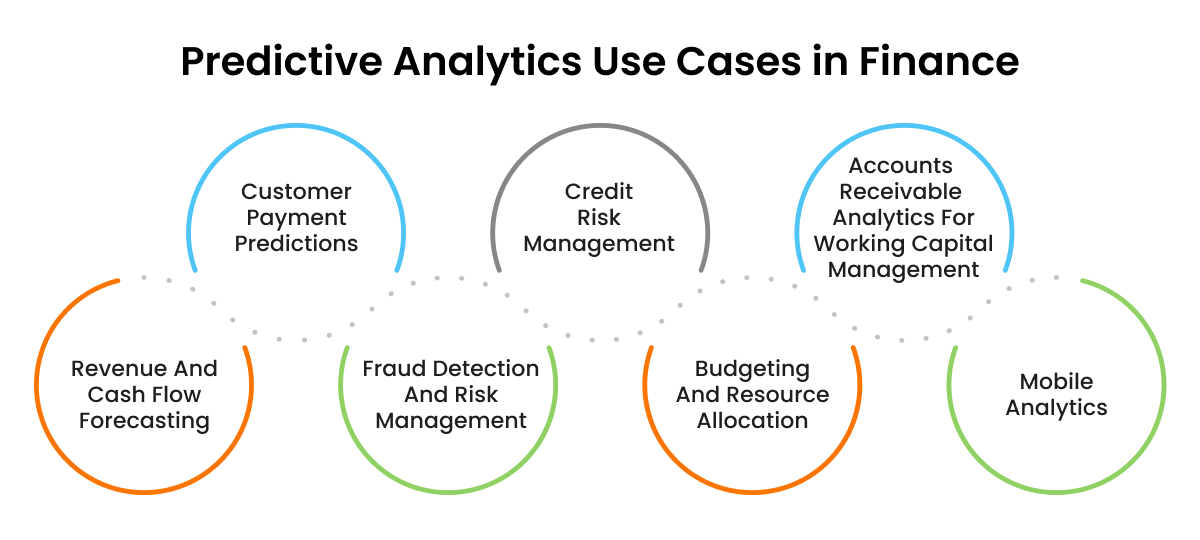

The Power of Predictive Analytics in Financial Services

Predictive analytics is rapidly transforming the financial services industry by enabling institutions to forecast future outcomes with greater precision, agility, and strategic insight. Powered by big data, machine learning, and…

FinTech Tools That Are Changing Financial Forecasting Forever

FinTech tools are revolutionizing financial forecasting by replacing static spreadsheets and historical-only models with real-time, data-driven, and predictive technologies. These modern tools leverage artificial intelligence (AI), machine learning, big data…

Why Financial APIs Are the Backbone of Modern FinTech

Financial APIs (Application Programming Interfaces) have become the backbone of modern FinTech, enabling seamless connectivity and interoperability between diverse financial systems, platforms, and services. By allowing different software applications to…

How FinTech is Transforming Risk Assessment in Finance

FinTech is revolutionizing risk assessment in finance by leveraging advanced technologies such as artificial intelligence, machine learning, and big data analytics to create more accurate, dynamic, and inclusive models. Traditional…

Digital Identity and Security in the FinTech Era

In the rapidly evolving FinTech era, digital identity and security have become foundational pillars that ensure trust, privacy, and safety in financial transactions and services. As financial platforms increasingly operate…

Why FinTech is Key to Unlocking SME Growth Globally

Small and Medium Enterprises (SMEs) are widely recognized as the backbone of the global economy, yet many face persistent challenges accessing traditional financial services necessary for growth and sustainability. FinTech…

FinTech-Powered Cash Flow Solutions for Businesses

FinTech-powered cash flow solutions are transforming how businesses manage their finances by offering innovative, technology-driven tools that enhance liquidity, optimize payment cycles, and provide greater financial visibility. Traditional cash flow…

Revolutionizing B2B Lending with FinTech Platforms

FinTech platforms are radically transforming the B2B lending landscape by introducing faster, more flexible, and data-driven financing solutions that better meet the needs of businesses. Traditional B2B lending, often characterized…

The Role of Quantum Computing in the Future of Finance

Quantum computing promises to revolutionize the finance industry by tackling complex problems that are currently beyond the reach of classical computers. With its ability to process vast amounts of data…

Sustainable Finance Meets FinTech: Green Innovations in Banking

Sustainable finance is rapidly gaining momentum as financial institutions and stakeholders recognize the urgent need to address environmental challenges and promote responsible investment. FinTech is playing a crucial role in…

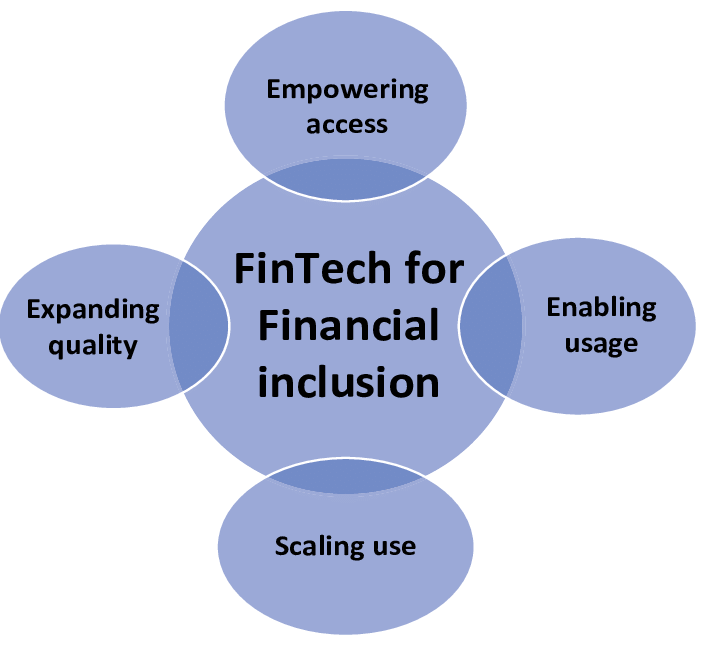

How FinTech is Powering Financial Inclusion Worldwide

FinTech is emerging as a powerful force driving financial inclusion across the globe, breaking down longstanding barriers that have kept millions underserved or entirely excluded from the formal financial system.…

Decoding FinTech Disruption in Traditional Banking

FinTech disruption is rewriting the rules of traditional banking by introducing innovative technologies and business models that challenge long-standing practices and customer expectations. Banks, once the uncontested gatekeepers of financial…

FinTech Frontiers: Exploring the Next Wave of Financial Innovation

The landscape of financial technology is continuously evolving, pushing boundaries and opening new frontiers that redefine how money moves, is managed, and creates value. The next wave of financial innovation…

FinTech Forward: The Future of Finance is Now

The future of finance isn’t a distant vision—it’s unfolding today, powered by the relentless innovation of FinTech. This new era is defined by the fusion of cutting-edge technologies like artificial…

Building Scalable Financial Solutions with FinTech

In today’s fast-paced digital economy, scalability is the cornerstone of successful financial solutions, and FinTech is the key enabler. Traditional financial systems often struggle to grow efficiently, constrained by legacy…

How FinTech is Reshaping B2B Payments and Lending

FinTech is transforming the landscape of B2B payments and lending, shifting away from rigid, manual processes toward agile, intelligent, and real-time financial systems. Traditionally, B2B transactions were slow, burdened by…

From Legacy to Digital: The FinTech Shift in B2B Finance

Business-to-business (B2B) finance is undergoing a seismic shift as legacy systems give way to agile, tech-driven platforms that offer greater speed, transparency, and control. For decades, B2B transactions were bogged…

The FinTech Stack: Tools Powering Modern Finance

Modern finance is being built on a sophisticated, evolving technology stack—an interconnected set of tools and platforms that are powering the next generation of financial services. At the foundation of…

Transforming Financial Services Through Technology

Technology is reshaping the financial services industry from the ground up—streamlining operations, enhancing customer experience, and expanding access to financial tools in ways once thought impossible. What used to take…

Digital Finance Unlocked

Digital finance is no longer just a trend—it’s a transformation that has unlocked a new era of possibility in how we manage, move, and multiply money. With smartphones as wallets,…

Tech-Driven Finance: Smarter, Faster, Better

Technology is reshaping the very fabric of finance, making it smarter, faster, and better than ever before. We’ve moved beyond simple digitization into an era of intelligent automation, hyper-personalization, and…

Rewiring Finance: Insights from the FinTech Frontier

Finance is being fundamentally rewired—pushed beyond traditional systems by the bold innovations emerging from the FinTech frontier. What began as incremental digital improvements has evolved into a sweeping redefinition of…

Where Finance Meets Innovation

Finance is no longer confined to traditional brick-and-mortar institutions or outdated systems—today, it is rapidly evolving through the power of innovation. The convergence of finance and technology is reshaping the…

The Rise of Financial Super Apps: Revolutionizing How We Manage Money

Financial super apps are rapidly transforming the way people manage their money by consolidating a wide range of financial services into a single, seamless platform. Unlike traditional banking apps that…

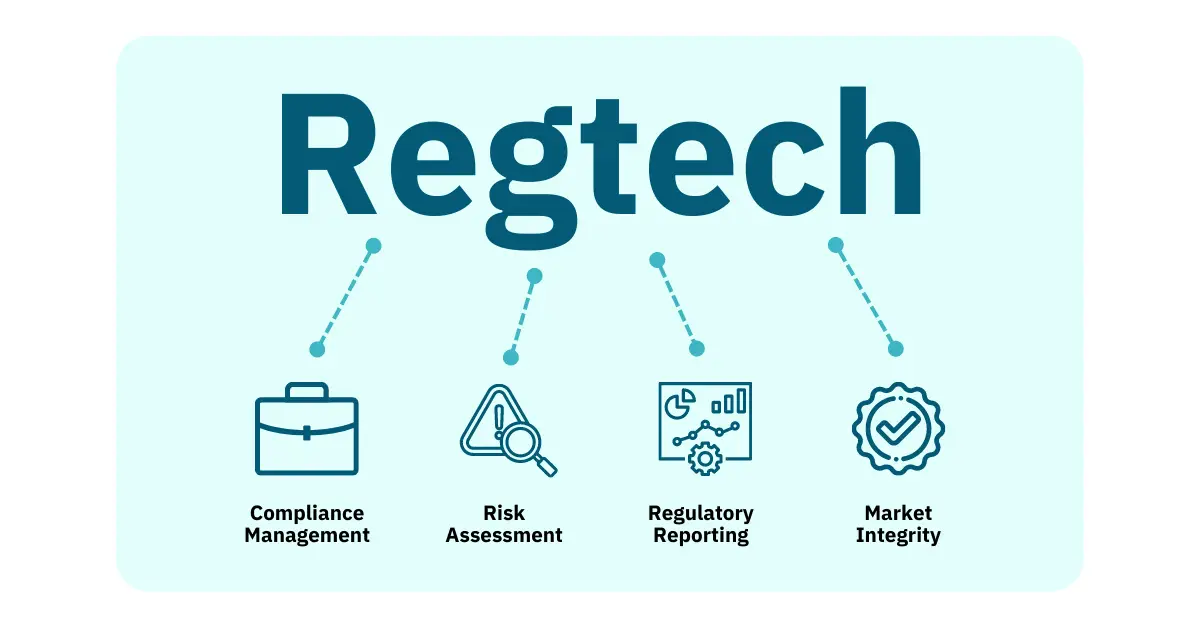

The Convergence of Fintech and Regtech for Smarter Compliance

As the financial industry becomes increasingly digitized, the convergence of fintech and regtech is driving a revolutionary shift in how businesses manage regulatory compliance. Fintech’s rapid innovation in payments, lending,…

How Fintech is Powering Subscription Economy Payments

The subscription economy has exploded in recent years, transforming everything from entertainment and software to food delivery and fitness services. Behind this rapid growth, fintech innovations are playing a pivotal…

The Intersection of IoT and FinTech: New Financial Possibilities

The Intersection of IoT and FinTech: New Financial Possibilities FinTech’s Influence on Corporate Treasury Optimization

FinTech’s Influence on Corporate Treasury Optimization The New Age of Financial Collaboration: FinTech Ecosystems

The New Age of Financial Collaboration: FinTech Ecosystems Why FinTech Should Be at the Heart of Your Digital Strategy

Why FinTech Should Be at the Heart of Your Digital Strategy The Impact of FinTech on Financial Data Transparency

The Impact of FinTech on Financial Data Transparency Transforming Wealth Management with FinTech Innovations

Transforming Wealth Management with FinTech Innovations Unlocking Liquidity with FinTech in Corporate Markets

Unlocking Liquidity with FinTech in Corporate Markets How FinTech is Accelerating Regulatory Compliance for Firms

How FinTech is Accelerating Regulatory Compliance for Firms The Rise of Decentralized Finance (DeFi) in Corporate Finance

The Rise of Decentralized Finance (DeFi) in Corporate Finance Leveraging Big Data to Drive Financial Strategy with FinTech

Leveraging Big Data to Drive Financial Strategy with FinTech Decoding Fintech: Tools Reshaping Personal Finance

Decoding Fintech: Tools Reshaping Personal Finance The Cashless Shift: Future of Payments in a Digital Age

The Cashless Shift: Future of Payments in a Digital Age Beyond Banks: Exploring the Fintech Revolution

Beyond Banks: Exploring the Fintech Revolution