FinTech’s Next Frontier: Beyond Payments and Lending

FinTech has undeniably revolutionized payments and lending, making financial transactions faster, more accessible, and more convenient. However, the industry’s most exciting innovations are now pushing beyond these traditional pillars into…

The Underrated Tech Disrupting Financial Services Today

In the fast-paced world of financial services, innovation is often associated with flashy technologies like blockchain, artificial intelligence, and cryptocurrencies. However, beneath these headline-grabbing trends lies a group of underrated…

How FinTech Is Quietly Reshaping Global Economies

In recent years, FinTech has evolved from a niche sector into a powerful force quietly transforming global economies. Beyond flashy apps and digital wallets, FinTech innovations are driving financial inclusion,…

FinTech Innovations You Haven’t Heard About—Yet

The FinTech industry is often synonymous with buzzwords like blockchain, AI, and digital wallets, but beyond these headline-grabbing technologies, a wave of lesser-known innovations is quietly reshaping the future of…

Lending in the AI Era: Fairer, Faster, Smarter

The lending landscape is undergoing a dramatic transformation thanks to the integration of artificial intelligence (AI). Traditional lending processes, once burdened by manual credit assessments, lengthy approvals, and potential biases,…

Blockchain Beyond Crypto: Real FinTech Use Cases

Blockchain technology is often synonymous with cryptocurrencies like Bitcoin and Ethereum, but its potential extends far beyond digital coins. In the FinTech world, blockchain is revolutionizing traditional financial services by…

AI and Finance: Smarter Than Ever?

Artificial Intelligence (AI) has rapidly moved from a futuristic concept to an essential driver of innovation across the finance industry. Today, AI is not just automating routine tasks—it’s fundamentally reshaping…

The Rise of No-Code in FinTech Platforms

The financial technology (FinTech) landscape is evolving at a breakneck pace, and one of the most transformative trends shaking up the industry is the rise of no-code platforms. Traditionally, developing…

KYC Reinvented: Faster, Safer, Smarter

Know Your Customer (KYC) processes have long been a critical but cumbersome part of financial services. Designed to prevent fraud, money laundering, and terrorism financing, KYC checks often slow down…

Crypto Crackdown: How Regulations Are Shaping Web3

The explosive growth of Web3 and the broader crypto ecosystem has sparked both excitement and anxiety—especially among global regulators. What began as a decentralized, borderless financial experiment is now a…

New Rules for Digital Finance: What You Need to Know

The digital finance revolution has unlocked convenience, speed, and global access like never before—but it has also triggered a wave of regulatory evolution. As digital wallets, crypto platforms, neobanks, and…

FinTech and the Fight Against Fraud: What’s Working?

Financial technology—better known as FinTech—has revolutionized the way we handle money, invest, and transact. But with innovation comes risk, and fraudsters have kept pace with the digital transformation. As cyber…

Blockchain-Powered Voting Systems: Redefining Corporate Governance in Finance

In 2025, blockchain-powered voting systems are revolutionizing corporate governance within the financial sector by enhancing transparency, security, and shareholder engagement. Traditional voting methods in corporate governance—such as proxy voting and…

Financial Inclusion Through Satellite Internet: Fintech’s New Frontier

In 2025, satellite internet is emerging as a critical enabler for financial inclusion, expanding fintech’s reach into the most remote and underserved regions of the world. Traditional internet infrastructure often…

Using Fintech to Tokenize Time: The Rise of Hour-Based Economy Models

In 2025, fintech innovations are enabling the tokenization of time, giving rise to hour-based economy models that transform how value is exchanged and monetized. By converting time—whether work hours, service…

Digital Barter Networks: The Next Evolution in Peer-to-Peer Finance

In 2025, digital barter networks are emerging as a transformative force in peer-to-peer finance, enabling individuals and businesses to exchange goods and services without traditional currency. Leveraging blockchain, smart contracts,…

How AI Is Automating Financial Therapy and Mental Wellness Coaching

In 2025, artificial intelligence (AI) is playing an increasingly vital role in automating financial therapy and mental wellness coaching, merging emotional well-being with smart financial guidance. Financial stress is a…

Fintech Platforms Enabling Real-Time Royalties for Creators and Artists

In 2025, fintech platforms are revolutionizing how creators and artists get paid by enabling real-time royalty payments. Traditionally, artists faced long delays, opaque accounting, and complex intermediaries that slowed down…

AI-Powered Chatbots That Can Negotiate Loan Terms for You

In 2025, AI-powered chatbots are transforming the loan negotiation landscape by acting as personalized financial advocates for borrowers. These intelligent agents use natural language processing (NLP), machine learning, and real-time…

Fintech’s Invisible Infrastructure: The APIs Powering Your Day

In 2025, fintech application programming interfaces (APIs) have become the silent engines powering everyday financial experiences around the globe. Though largely invisible to consumers, these APIs enable seamless connectivity between…

Micro-Donations and Fintech: The Future of Charitable Giving

In 2025, fintech is revolutionizing philanthropy by enabling micro-donations—small, seamless contributions made through digital platforms that, collectively, wield massive impact. Enabled by APIs, mobile wallets, payment integrations, and real-time data…

AI Judges in Financial Disputes: The New Face of Arbitration?

In 2025, artificial intelligence is stepping into a controversial but rapidly evolving role: resolving financial disputes as a digital arbitrator. Across sectors like digital lending, insurance, consumer banking, and decentralized…

The Quiet Rise of Privacy Coins in Everyday Payments

In 2025, privacy coins—cryptocurrencies specifically designed to enhance transaction anonymity—are steadily gaining traction in everyday payments, quietly reshaping the digital commerce landscape. While Bitcoin and Ethereum dominate headlines, coins like…

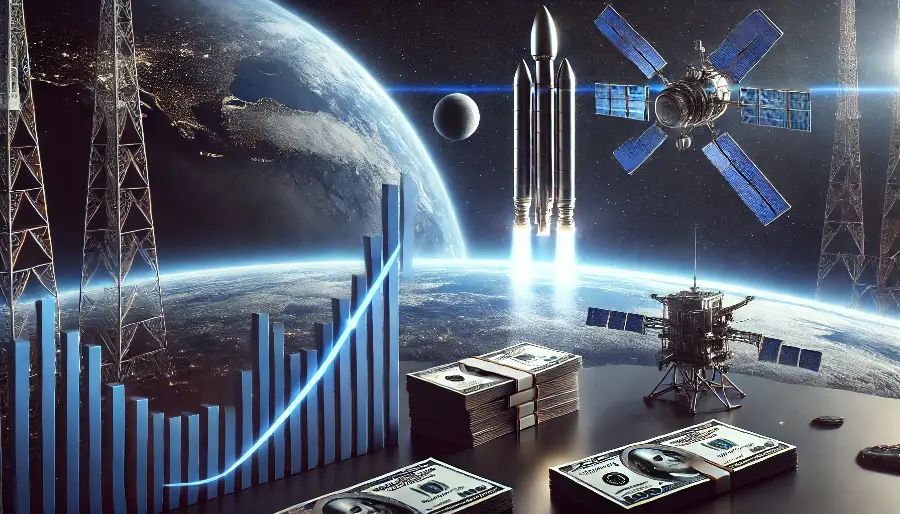

Fintech’s Role in Financing the Space Economy: Moonshot Investments

In 2025, fintech is playing an increasingly pivotal role in financing the fast-growing space economy—an emerging sector that spans satellite technology, space tourism, orbital logistics, and lunar exploration. With traditional…

How Digital Bartering Platforms Are Disrupting Traditional Finance

In 2025, digital bartering platforms are emerging as innovative disruptors to traditional finance by enabling direct exchange of goods and services without relying on conventional currency systems. These platforms leverage…

Next-Level Fraud Prevention: AI-Powered Threat Detection in Fintech

In 2025, AI-powered threat detection is transforming fraud prevention within fintech, providing sophisticated, real-time defenses against increasingly complex and evolving cyber threats. By leveraging advanced machine learning algorithms, behavioral analytics,…

Revolutionizing Payments: The Rise of Biometric Authentication in Fintech

In 2025, biometric authentication is revolutionizing the payments landscape within fintech, offering a secure, seamless, and user-friendly alternative to traditional password and PIN-based systems. Technologies such as fingerprint scanning, facial…

Open Finance APIs Drive Collaborative Innovation Among Fintechs

In 2025, Open Finance APIs have become a cornerstone for fintech innovation, enabling unprecedented levels of collaboration across the financial ecosystem. By providing secure, standardized access to financial data and…

Big Tech and Banks Forge New Alliances to Deliver Embedded Finance

In 2025, the collaboration between Big Tech companies and traditional banks is intensifying, creating powerful alliances aimed at delivering embedded finance solutions seamlessly integrated into everyday digital experiences. By combining…

Middle East Accelerates Fintech Innovation with Sovereign Wealth Support

In 2025, the Middle East is witnessing an unprecedented surge in fintech innovation, propelled largely by strategic investments and backing from sovereign wealth funds (SWFs). These government-owned investment vehicles are…

Digital Financial Inclusion Programs Gain Traction in Sub-Saharan Africa

In 2025, digital financial inclusion programs across Sub-Saharan Africa are rapidly expanding, driven by mobile technology, fintech innovation, and a growing focus on inclusive economic development. Millions of previously unbanked…

Latin America’s Crypto Adoption Surpasses Traditional Banking Use

In 2025, Latin America has reached a historic inflection point: for the first time, active use of cryptocurrencies has surpassed engagement with traditional banking services across several countries in the…

Fintech Cyber Insurance Market Expands Amid Rising Threats

In 2025, as cyberattacks against fintech platforms surge in frequency and sophistication, the cyber insurance market tailored specifically for fintech companies is experiencing rapid expansion. With the rise of digital…

Multi-Party Computation Redefines Data Sharing in Collaborative Banking

In 2025, Multi-Party Computation (MPC) is revolutionizing data sharing in collaborative banking environments by enabling multiple institutions to jointly analyze sensitive financial data without exposing underlying information to one another.…

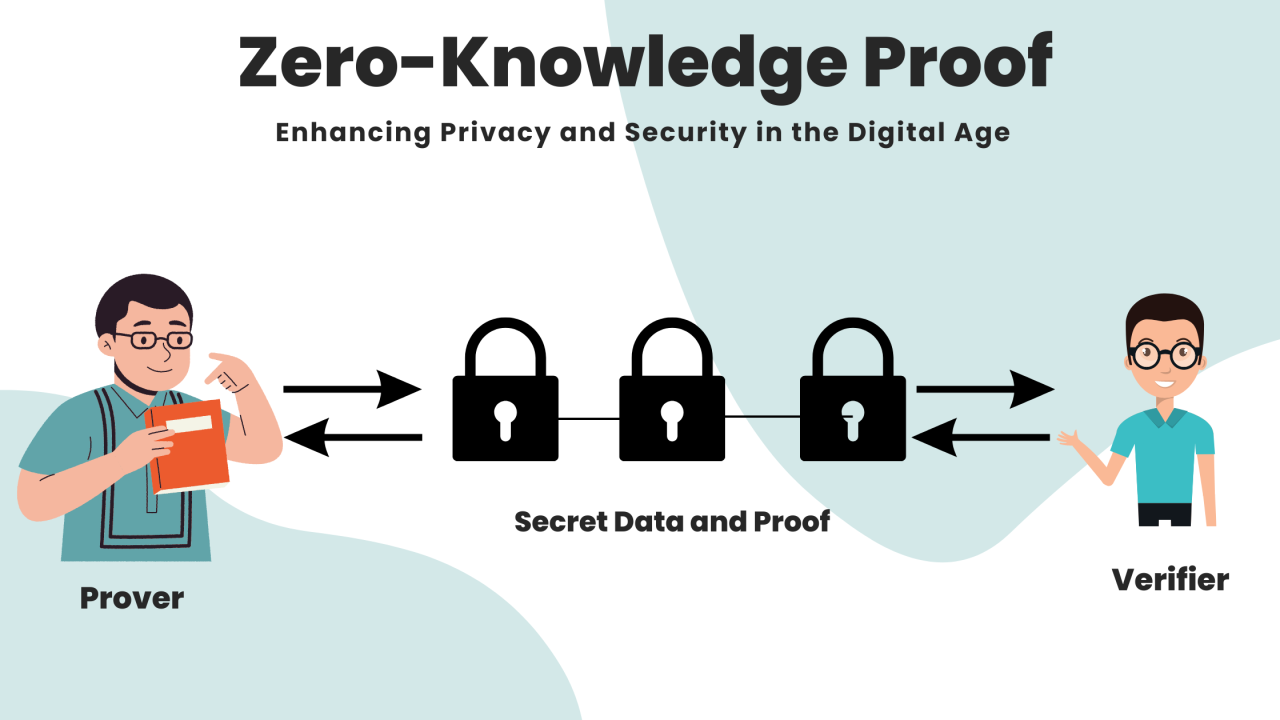

Zero-Knowledge Proofs Enhance Privacy in Blockchain Finance

In 2025, zero-knowledge proofs (ZKPs) have emerged as a groundbreaking technology in blockchain finance, significantly enhancing privacy without sacrificing transparency or security. ZKPs allow one party to prove to another…

Financial Data Marketplaces Emerge as the Next Big Fintech Asset

In 2025, financial data marketplaces are rapidly becoming a pivotal asset class within the fintech ecosystem, fundamentally reshaping how data is shared, monetized, and leveraged across industries. These marketplaces act…

Decentralized Identity Systems Promise to Revolutionize KYC Processes

In 2025, decentralized identity (DID) systems are poised to transform Know Your Customer (KYC) processes across the financial industry by enhancing security, privacy, and user control. Unlike traditional centralized identity…

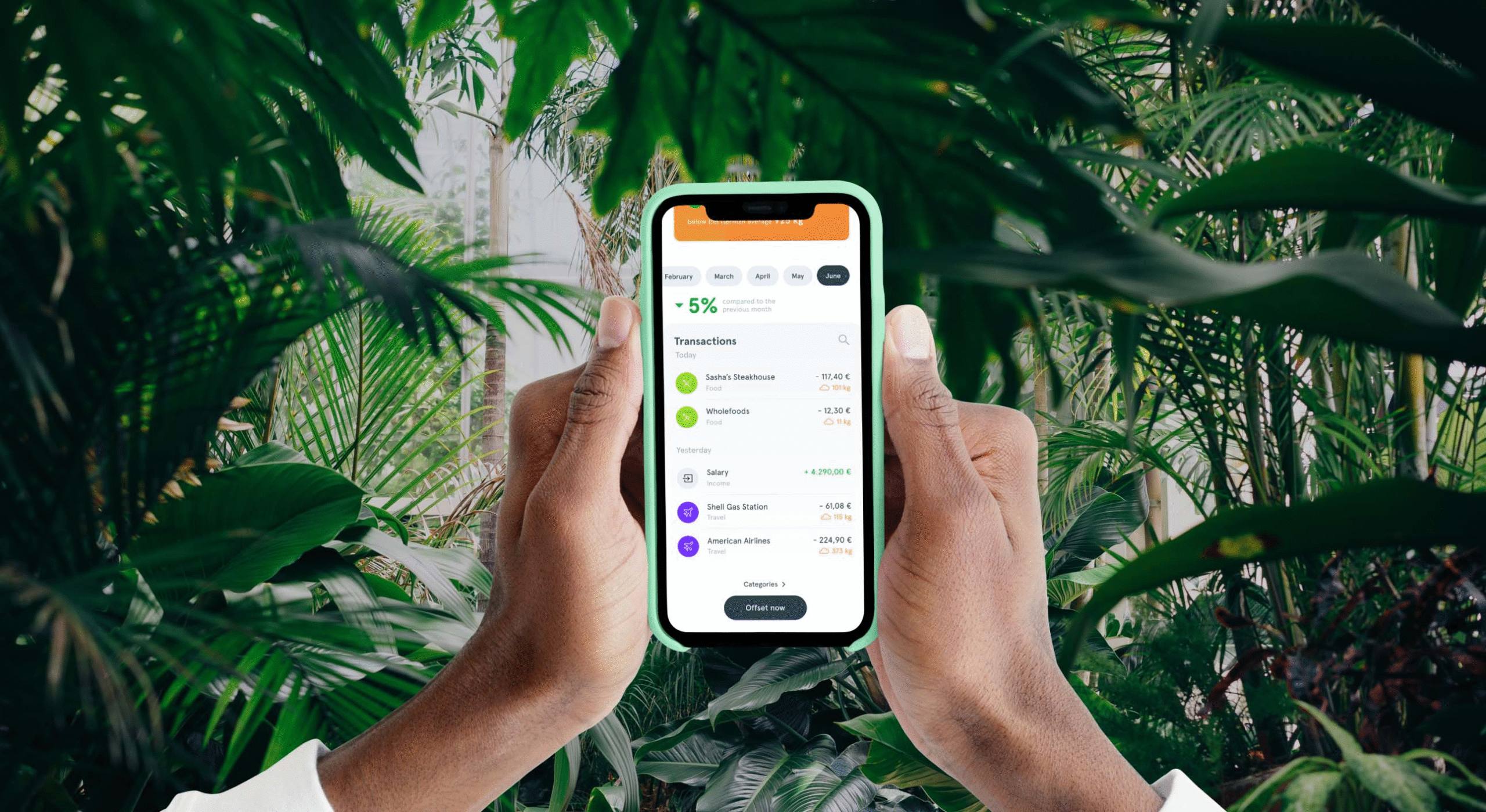

Green Wallets: Track Your Carbon Footprint with Every Transaction

In 2025, a new breed of “green wallets” is helping consumers align everyday spending with environmental impact by automatically tracking the carbon footprint of each transaction. Built by fintech innovators…

Fintech Startups Launch Climate Risk Dashboards for Retail Investors

In 2025, fintech startups are transforming how individual investors evaluate sustainability by launching climate risk dashboards tailored specifically for the retail market. These platforms provide intuitive, data-rich tools that visualize…

Small Business Lending Platforms Partner with POS Providers for Hyperlocal Financing

In 2025, a new wave of hyperlocal financing is reshaping small business credit access through strategic partnerships between digital lending platforms and point-of-sale (POS) providers. These integrations allow lenders to…

The Intersection of IoT and FinTech: New Financial Possibilities

The Intersection of IoT and FinTech: New Financial Possibilities FinTech’s Influence on Corporate Treasury Optimization

FinTech’s Influence on Corporate Treasury Optimization The New Age of Financial Collaboration: FinTech Ecosystems

The New Age of Financial Collaboration: FinTech Ecosystems Why FinTech Should Be at the Heart of Your Digital Strategy

Why FinTech Should Be at the Heart of Your Digital Strategy The Impact of FinTech on Financial Data Transparency

The Impact of FinTech on Financial Data Transparency Transforming Wealth Management with FinTech Innovations

Transforming Wealth Management with FinTech Innovations Unlocking Liquidity with FinTech in Corporate Markets

Unlocking Liquidity with FinTech in Corporate Markets How FinTech is Accelerating Regulatory Compliance for Firms

How FinTech is Accelerating Regulatory Compliance for Firms The Rise of Decentralized Finance (DeFi) in Corporate Finance

The Rise of Decentralized Finance (DeFi) in Corporate Finance Leveraging Big Data to Drive Financial Strategy with FinTech

Leveraging Big Data to Drive Financial Strategy with FinTech Decoding Fintech: Tools Reshaping Personal Finance

Decoding Fintech: Tools Reshaping Personal Finance The Cashless Shift: Future of Payments in a Digital Age

The Cashless Shift: Future of Payments in a Digital Age Beyond Banks: Exploring the Fintech Revolution

Beyond Banks: Exploring the Fintech Revolution