Finance was once driven purely by human logic, manual oversight, and institutional memory. Today, it’s increasingly powered by systems that learn—constantly, silently, and at scale. Artificial intelligence, machine learning, and adaptive algorithms are no longer experimental tools—they’re embedded in underwriting models, trading platforms, fraud detection engines, and customer service bots. These systems don’t just automate—they evolve. They spot patterns before humans do, make decisions based on real-time data, and shift strategy as markets change. The result is a financial ecosystem that doesn’t just respond—it anticipates. We write about this moment of transformation, where financial systems start to think for themselves—and where the consequences are profound, complex, and deeply human.

When Risk Models Learn in Real Time

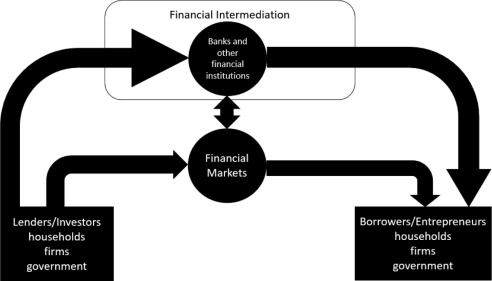

In traditional finance, risk was managed through fixed rules, historical data, and standardized frameworks. Now, machine learning models adjust risk assessments dynamically, learning from each new transaction, market shift, or borrower behavior. Banks can now tailor credit scores by the second. Hedge funds train AI to adapt trading strategies overnight. Insurers spot fraud before a claim is filed. These thinking systems don’t just improve efficiency—they reshape how trust and risk are calculated. But as models get smarter, they also get harder to explain, raising urgent questions about transparency and accountability. We track where that line is drawn—and who gets to draw it.

Personalized Finance at Machine Speed

AI-driven personalization means no two users are treated the same. Algorithms determine what loan you’re offered, what investment advice you receive, even how your spending is categorized. These systems learn from behavior—what you buy, when you save, where you invest—and refine their recommendations accordingly. For consumers, that can mean smarter decisions and better outcomes. But it also means submitting your financial identity to a system you don’t fully control. We dig into how these systems shape individual financial journeys, and who benefits—or is left behind—when finance starts tailoring itself at the speed of code.

Decision-Making Without a Human in the Loop

More and more financial decisions—approvals, rejections, flaggings—are made without human oversight. Automated systems drive real-time settlement, algorithmic trading, and even regulatory compliance. This speed creates enormous efficiency but also introduces new kinds of risk: model errors, data biases, and blind spots no one sees until something breaks. As financial systems learn to think, we ask: when is automation a benefit, and when is it a liability? What happens when something goes wrong, and no one fully understands why? We examine the trade-offs of machine-scale thinking in a system that still affects human lives.

Conclusion

When financial systems learn to think, the entire logic of money changes. It becomes adaptive, predictive, and, in some cases, autonomous. This isn’t just an upgrade—it’s a philosophical shift in how decisions are made and who (or what) makes them. As these systems grow more powerful and complex, our role is to make sense of their design, their behavior, and their impact. Because when finance starts to think, the real story isn’t just about technology—it’s about what happens next.