The Untold Story of How Fintech Is Empowering the Unbanked Globally

More than 1.4 billion people worldwide remain unbanked, lacking access to basic financial services such as savings accounts, credit, and insurance. This exclusion perpetuates poverty, limits economic opportunities, and widens…

Why Finance Needs to Embrace Agility to Survive the Tech Disruption

The financial industry stands at a crossroads. Rapid technological advancements—ranging from AI and blockchain to cloud computing and open banking—are transforming how financial services are designed, delivered, and consumed. Traditional…

Unlocking Financial Freedom Through Tech-Enabled Personalized Solutions

Financial freedom—a state where individuals have control over their money, freedom from debt, and the ability to pursue their goals—is a universal aspiration. Yet, the path to this ideal has…

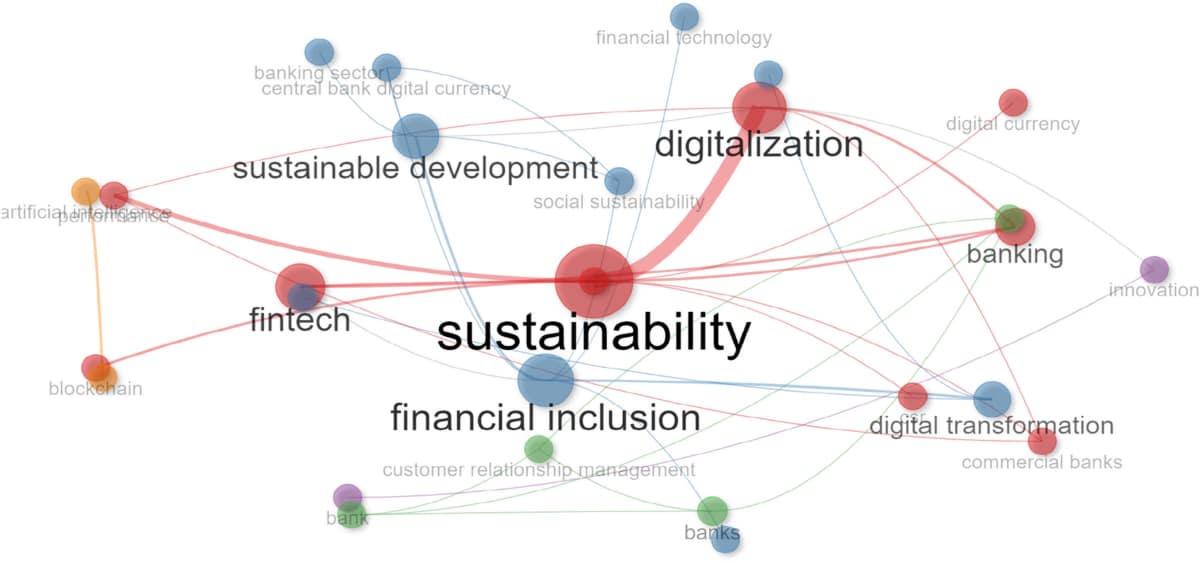

What the Intersection of Fintech and Sustainability Means for the Future of Money

As the world faces mounting environmental challenges and a growing demand for responsible business practices, finance is evolving beyond profit to prioritize sustainability and social impact. At the heart of…

How Technology Is Turning Traditional Finance Into a Seamless Digital Experience

The face of finance is undergoing a dramatic transformation. Where once banking meant long queues, piles of paperwork, and complex procedures, today’s financial landscape is defined by speed, accessibility, and…

Why the Next Financial Crisis Might Be Prevented by AI, Not Economists

Financial crises have historically caught experts and markets off guard, triggering widespread economic pain and uncertainty. Despite decades of analysis and increasingly sophisticated economic models, human-led institutions have struggled to…

If Money Could Move on Its Own, What Would It Do Differently?

Imagine a world where money doesn’t just sit passively in bank accounts or wallets, waiting for us to move it—it moves itself, intelligently navigating the financial landscape to optimize growth,…

How Quiet Code Is Shaping Loud Markets: A New Narrative in Fintech

In the bustling, high-stakes world of global finance, headlines often spotlight soaring stock prices, massive IPOs, or dramatic market swings. Yet behind these loud, public events lies a quieter revolution—one…

In the Age of Predictive Finance, Are We Still in Control of Our Money?

Finance has entered a new era—one where artificial intelligence, machine learning, and big data converge to forecast spending habits, investment opportunities, and even creditworthiness with remarkable accuracy. This is the…

The Death of Delay: How Real-Time Finance Is Reprogramming Business

In today’s hyperconnected world, speed is king. Businesses can no longer afford to wait hours, days, or even weeks for financial transactions, approvals, or data updates. The era of delay—of…

This Isn’t Banking Anymore: Why Financial Infrastructure Is Morphing into Digital Ecosystems

The financial services industry is undergoing a transformation so profound that the very concept of “banking” as we know it is rapidly fading. Traditional banks and standalone financial products are…

Can a Line of Code Be Trusted with a Billion Dollars? Welcome to Smart Finance

In traditional finance, managing billions of dollars involves armies of lawyers, compliance officers, and intermediaries ensuring every clause is followed and every transaction authorized. But what if all those manual…

When Finance Thinks for Itself: How Autonomous Systems Are Rewriting Capital Flow

The financial world is undergoing a quiet revolution—one where machines no longer just assist human decision-making but think, act, and optimize on their own. Autonomous financial systems, powered by artificial…

Why Your Digital Wallet Might Soon Replace Your Passport, ID, and Bank

The humble digital wallet, once just a convenient way to store payment cards on your phone, is rapidly evolving into something far more powerful and transformative. Imagine a single, secure…

What If Finance Had No Middlemen? Exploring a World Rewired by Tech

For decades, financial intermediaries—banks, brokers, payment processors, and insurers—have acted as the essential middlemen, connecting individuals, businesses, and markets. They verify transactions, manage risks, and facilitate trust. But what if…

When Algorithms Manage Wealth: A Look Into the New Era of Smart Finance

Once the domain of human advisors, wealth management has entered a transformative new era—one led by algorithms, automation, and artificial intelligence. From personalized portfolio rebalancing to risk assessment and tax…

What the Latest Fintech Mergers Mean for the Future of Financial Services

The fintech landscape is entering a new phase: consolidation. In recent years, we’ve seen an uptick in mergers and acquisitions across the financial technology space—ranging from digital lenders and neobanks…

How Fintech Is Helping Consumers Navigate the Complexities of Taxes

For most people, tax season brings a familiar mix of confusion, stress, and last-minute scrambling. From decoding deductions to filing returns on time, navigating taxes has traditionally been complicated, opaque,…

Why Financial Literacy and Fintech Are Becoming Inseparable Partners

For decades, the biggest gap in personal finance wasn’t just access—it was understanding. Millions of people had access to bank accounts, credit cards, or loans, but lacked the knowledge to…

How Fintech Is Enabling Real-Time Financial Decisions Like Never Before

In the traditional world of finance, decision-making was often delayed by paperwork, approval chains, outdated systems, and a lack of timely data. But fintech has changed the rhythm. Today, individuals…

What Fintech Can Teach Us About Building Financial Systems for the Future

For centuries, financial systems have been built on rigid foundations—centralized institutions, legacy infrastructure, and policies designed for slower economies. But the rise of fintech has challenged these norms. Agile, digital,…

When money meets technology, the rules shift—our job is to explain how.

The meeting point of money and technology is not just a collision—it’s a transformation. Every time code replaces a contract, or a smart wallet replaces a teller, the rules change.…

How Fintech Is Making Wealth Management More Accessible to All

Wealth management has traditionally been an exclusive service reserved for the affluent and institutional investors. High fees, complex products, and opaque advice often kept everyday people at arm’s length. But…

Why Fintech Adoption Is Accelerating Faster Than Industry Experts Predicted

Just a few years ago, fintech was still considered a promising but niche segment of the financial world. Experts predicted steady growth over time, especially among digital natives. But what…

The Role of Fintech in Creating Financial Resilience During Global Crises

Global crises—whether economic downturns, pandemics, climate disasters, or geopolitical shocks—have a way of exposing the weaknesses in traditional financial systems. Access to funds dries up, small businesses collapse, and vulnerable…

How Fintech Innovations Are Changing the Way We Think About Insurance

Insurance has long been seen as a slow-moving industry—complex, opaque, and largely reactive. But fintech is rapidly changing that perception. By applying digital tools, data analytics, and customer-first thinking, fintech…

Why Decentralized Finance and Traditional Fintech Are Starting to Collaborate

For years, decentralized finance (DeFi) and traditional fintech seemed destined to follow different paths. DeFi, powered by blockchain and smart contracts, was built on ideals of transparency, autonomy, and disruption.…

How Fintech Is Shaping the Future of Cross-Border Payments and Remittances

Cross-border payments and remittances have long been plagued by slow transfer times, high fees, and lack of transparency. For decades, sending money internationally meant navigating complex banking systems, relying on…

What You Didn’t Know About Fintech’s Influence on Everyday Spending

When people hear the word “fintech,” they often think of flashy apps, cryptocurrency, or high-level banking innovation. But in reality, fintech’s influence is far more subtle—and far more personal. It’s…

How Fintech Is Reimagining Credit Scoring for a Digital Generation

For decades, credit scoring has relied on outdated models: fixed formulas, traditional banking relationships, and narrow definitions of financial responsibility. These legacy systems have excluded millions—especially young people, freelancers, immigrants,…

Why Fintech Could Be the Secret Weapon for Emerging Economies

Emerging economies are often defined by dual realities: fast-growing populations full of entrepreneurial energy, and financial systems that lag in access, efficiency, or inclusiveness. But that gap presents an enormous…

What Happens When Fintech Meets the Metaverse: A New Financial Frontier

The future of finance is no longer just digital—it’s immersive. As the metaverse takes shape, blending virtual reality, decentralized platforms, and persistent digital environments, a new frontier is emerging where…

How Fintech Is Bridging the Gap Between Technology and Financial Trust

For decades, financial trust was built on familiar institutions—brick-and-mortar banks, face-to-face interactions, and long-standing reputations. But as technology transformed the financial industry, many wondered: Can digital platforms earn the same…

Why Fintech’s Role in Climate Finance Could Be Its Biggest Legacy Yet

As the urgency to address climate change intensifies, the financial sector is rapidly evolving to support a greener, more sustainable future. At the heart of this transformation lies fintech—an unexpected…

How Fintech Is Turning Traditional Banking Upside Down in 2025

The year 2025 marks a pivotal moment in the evolution of finance. Fintech, once seen as a challenger to traditional banking, has now become a transformative force rewriting the rules…

The Unexpected Ways Fintech Is Empowering Financial Freedom Worldwide

When people think about fintech, they often picture convenient apps for payments or budgeting. But beneath the surface, fintech is quietly revolutionizing financial freedom on a global scale—empowering millions in…

Why Fintech’s Most Impactful Innovations Are Still Under the Radar

Fintech has become a household term, with flashy payment apps and digital wallets grabbing the spotlight. Yet, the most transformative fintech innovations—the ones fundamentally reshaping financial services and economies—often fly…

How Fintech Is Quietly Rewriting the Rules of Global Finance Today

In the background of the financial world’s bustling activity, fintech is quietly but profoundly reshaping the rules that have governed global finance for decades. Far beyond flashy payment apps or…

Fintech Innovations Are Driving a Financial Revolution You Didn’t See Coming

When most people think of fintech, they imagine convenient payment apps or quick online loans. But the reality is much bigger—and much more transformative. Fintech innovations are sparking a financial…

Fintech Adoption Just Hit a Milestone—Here’s What That Means for You

In recent years, fintech has evolved from a niche innovation to a mainstream financial force, fundamentally reshaping how people around the world manage money. And now, fintech adoption has officially…

MoneyVenture Unveils ‘Project Horizon’: Charting the Course to AI-Powered, Sustainable Profitability