Unlocking Liquidity with FinTech in Corporate Markets

FinTech is unlocking new levels of liquidity in corporate markets by providing digital tools and platforms that improve access to capital, enhance cash flow management, and streamline financial operations. Traditionally,…

How FinTech is Accelerating Regulatory Compliance for Firms

FinTech is fundamentally reshaping how firms manage regulatory compliance by introducing agile, automated, and intelligent solutions that reduce risk, cost, and complexity. Traditionally, compliance has been a resource-intensive function, requiring…

Why Financial APIs Are the Backbone of Modern FinTech

Financial APIs (Application Programming Interfaces) have become the backbone of modern FinTech, enabling seamless connectivity and interoperability between diverse financial systems, platforms, and services. By allowing different software applications to…

The Rise of Decentralized Finance (DeFi) in Corporate Finance

The rise of Decentralized Finance (DeFi) is reshaping corporate finance by introducing transparent, permissionless, and programmable financial systems that operate without traditional intermediaries like banks. Leveraging blockchain technology, DeFi platforms…

Leveraging Big Data to Drive Financial Strategy with FinTech

Leveraging big data is at the heart of FinTech’s ability to revolutionize financial strategy by enabling organizations to extract actionable insights from vast, diverse datasets. FinTech platforms harness big data…

How FinTech is Transforming Risk Assessment in Finance

FinTech is revolutionizing risk assessment in finance by leveraging advanced technologies such as artificial intelligence, machine learning, and big data analytics to create more accurate, dynamic, and inclusive models. Traditional…

Digital Identity and Security in the FinTech Era

In the rapidly evolving FinTech era, digital identity and security have become foundational pillars that ensure trust, privacy, and safety in financial transactions and services. As financial platforms increasingly operate…

Why FinTech is Key to Unlocking SME Growth Globally

Small and Medium Enterprises (SMEs) are widely recognized as the backbone of the global economy, yet many face persistent challenges accessing traditional financial services necessary for growth and sustainability. FinTech…

The Intersection of IoT and FinTech: New Financial Possibilities

The convergence of the Internet of Things (IoT) and FinTech is unlocking groundbreaking financial possibilities by combining vast networks of connected devices with innovative financial technologies. IoT generates continuous streams…

FinTech-Powered Cash Flow Solutions for Businesses

FinTech-powered cash flow solutions are transforming how businesses manage their finances by offering innovative, technology-driven tools that enhance liquidity, optimize payment cycles, and provide greater financial visibility. Traditional cash flow…

Revolutionizing B2B Lending with FinTech Platforms

FinTech platforms are radically transforming the B2B lending landscape by introducing faster, more flexible, and data-driven financing solutions that better meet the needs of businesses. Traditional B2B lending, often characterized…

FinTech’s Influence on Corporate Treasury Optimization

FinTech is fundamentally reshaping corporate treasury functions by introducing innovative technologies that enhance liquidity management, cash forecasting, and risk mitigation. Traditional treasury operations, often hampered by manual processes and fragmented…

The Role of Quantum Computing in the Future of Finance

Quantum computing promises to revolutionize the finance industry by tackling complex problems that are currently beyond the reach of classical computers. With its ability to process vast amounts of data…

Sustainable Finance Meets FinTech: Green Innovations in Banking

Sustainable finance is rapidly gaining momentum as financial institutions and stakeholders recognize the urgent need to address environmental challenges and promote responsible investment. FinTech is playing a crucial role in…

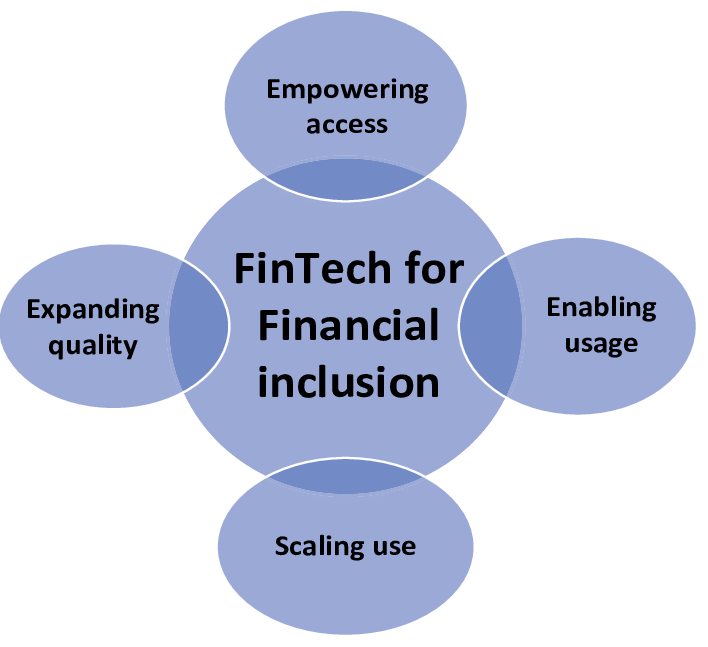

How FinTech is Powering Financial Inclusion Worldwide

FinTech is emerging as a powerful force driving financial inclusion across the globe, breaking down longstanding barriers that have kept millions underserved or entirely excluded from the formal financial system.…

Decoding FinTech Disruption in Traditional Banking

FinTech disruption is rewriting the rules of traditional banking by introducing innovative technologies and business models that challenge long-standing practices and customer expectations. Banks, once the uncontested gatekeepers of financial…

FinTech Frontiers: Exploring the Next Wave of Financial Innovation

The landscape of financial technology is continuously evolving, pushing boundaries and opening new frontiers that redefine how money moves, is managed, and creates value. The next wave of financial innovation…

FinTech Forward: The Future of Finance is Now

The future of finance isn’t a distant vision—it’s unfolding today, powered by the relentless innovation of FinTech. This new era is defined by the fusion of cutting-edge technologies like artificial…

Building Scalable Financial Solutions with FinTech

In today’s fast-paced digital economy, scalability is the cornerstone of successful financial solutions, and FinTech is the key enabler. Traditional financial systems often struggle to grow efficiently, constrained by legacy…

How FinTech is Reshaping B2B Payments and Lending

FinTech is transforming the landscape of B2B payments and lending, shifting away from rigid, manual processes toward agile, intelligent, and real-time financial systems. Traditionally, B2B transactions were slow, burdened by…

From Legacy to Digital: The FinTech Shift in B2B Finance

Business-to-business (B2B) finance is undergoing a seismic shift as legacy systems give way to agile, tech-driven platforms that offer greater speed, transparency, and control. For decades, B2B transactions were bogged…

The FinTech Stack: Tools Powering Modern Finance

Modern finance is being built on a sophisticated, evolving technology stack—an interconnected set of tools and platforms that are powering the next generation of financial services. At the foundation of…

Transforming Financial Services Through Technology

Technology is reshaping the financial services industry from the ground up—streamlining operations, enhancing customer experience, and expanding access to financial tools in ways once thought impossible. What used to take…

Digital Finance Unlocked

Digital finance is no longer just a trend—it’s a transformation that has unlocked a new era of possibility in how we manage, move, and multiply money. With smartphones as wallets,…

Tech-Driven Finance: Smarter, Faster, Better

Technology is reshaping the very fabric of finance, making it smarter, faster, and better than ever before. We’ve moved beyond simple digitization into an era of intelligent automation, hyper-personalization, and…

Rewiring Finance: Insights from the FinTech Frontier

Finance is being fundamentally rewired—pushed beyond traditional systems by the bold innovations emerging from the FinTech frontier. What began as incremental digital improvements has evolved into a sweeping redefinition of…

Where Finance Meets Innovation

Finance is no longer confined to traditional brick-and-mortar institutions or outdated systems—today, it is rapidly evolving through the power of innovation. The convergence of finance and technology is reshaping the…

The Rise of Financial Super Apps: Revolutionizing How We Manage Money

Financial super apps are rapidly transforming the way people manage their money by consolidating a wide range of financial services into a single, seamless platform. Unlike traditional banking apps that…

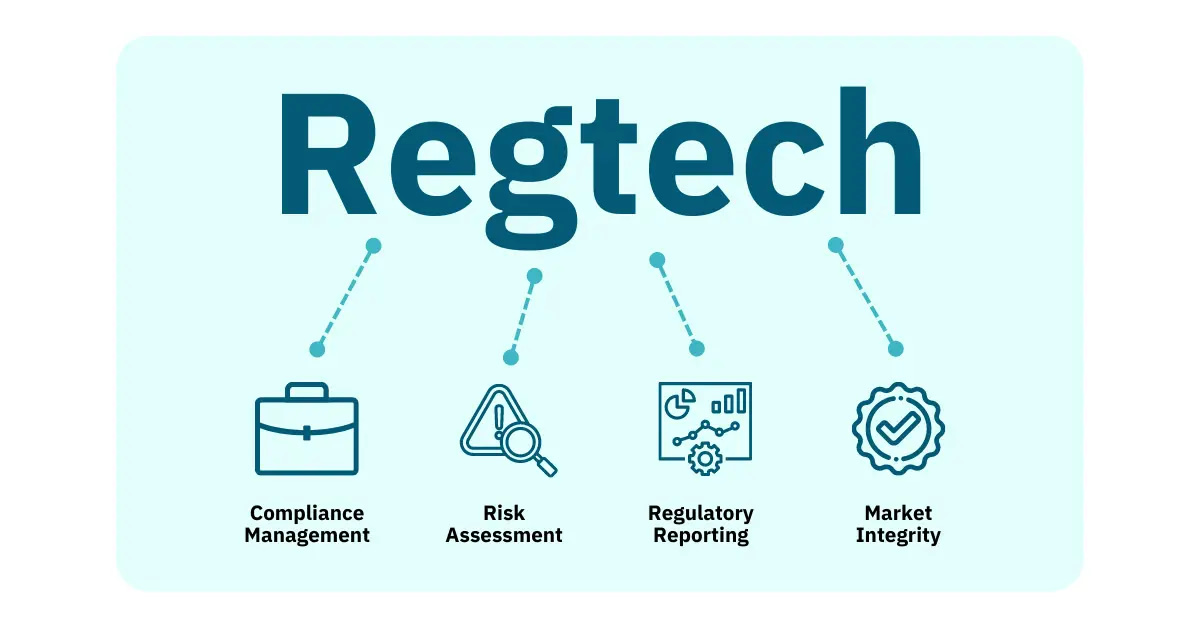

The Convergence of Fintech and Regtech for Smarter Compliance

As the financial industry becomes increasingly digitized, the convergence of fintech and regtech is driving a revolutionary shift in how businesses manage regulatory compliance. Fintech’s rapid innovation in payments, lending,…

How Fintech is Powering Subscription Economy Payments

The subscription economy has exploded in recent years, transforming everything from entertainment and software to food delivery and fitness services. Behind this rapid growth, fintech innovations are playing a pivotal…

FinTech Forward: The Future of Finance is Now

The financial world is undergoing a radical transformation, driven by the rise of FinTech—an intersection of finance and technology that is revolutionizing how we manage, invest, and interact with money.…

AI-Driven Credit Counseling: The New Financial Advisor

Artificial intelligence is revolutionizing credit counseling by transforming it into a highly personalized, accessible, and efficient service that goes beyond traditional financial advice. AI-driven credit counselors leverage machine learning algorithms…

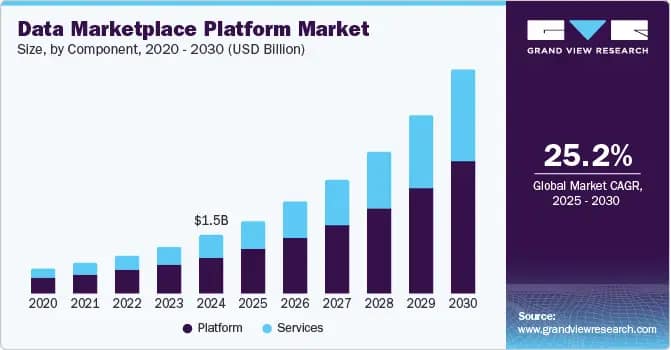

How Financial Data Marketplaces are Changing Investments

Financial data marketplaces are revolutionizing the investment landscape by making vast amounts of high-quality, diverse data easily accessible to investors, fund managers, and fintech firms. Traditionally, investors relied on limited…

The Evolution of Peer-to-Peer Lending Platforms in 2025

By 2025, peer-to-peer (P2P) lending platforms have undergone significant transformation, reshaping the way individuals and small businesses access credit while bypassing traditional financial institutions. Early P2P models focused primarily on…

How Fintech Startups are Simplifying Estate Planning

Estate planning has long been perceived as a complex and intimidating process, often reserved for the wealthy or those with legal expertise. However, fintech startups are dramatically changing this narrative…

Green Bonds and Fintech: Funding Climate Change Solutions

The urgent need to address climate change has accelerated the demand for sustainable financing, with green bonds emerging as a powerful tool to fund eco-friendly projects such as renewable energy,…

The Impact of Voice Tech on Financial Planning

Voice technology is rapidly transforming financial planning by introducing a hands-free, conversational way to interact with personal finance tools and services. With the rise of smart speakers, voice assistants, and…

How Fintech is Innovating Expense Tracking for Freelancers

Freelancers often juggle multiple clients, inconsistent income streams, and a blur of business and personal expenses—all of which make managing finances uniquely challenging. Fortunately, fintech is stepping up to transform…

Crowdfunding Meets Blockchain: Transparent Fundraising

The fusion of crowdfunding and blockchain technology is reshaping the fundraising landscape by making it more transparent, secure, and globally accessible. Traditional crowdfunding platforms often act as intermediaries, charging high…

How AI is Crafting Personalized Financial Roadmaps

Artificial Intelligence (AI) is revolutionizing personal finance by creating customized financial roadmaps that are tailored to an individual’s unique lifestyle, goals, and habits. Unlike traditional financial planning methods, which often…

MoneyVenture Unveils ‘Project Horizon’: Charting the Course to AI-Powered, Sustainable Profitability