Where digital rails carry old money into new worlds, we follow.

The financial world is in the midst of a transformation, where traditional money journeys through new, digital rails—complex technological infrastructures that move funds faster, safer, and across borders like never…

Money doesn’t move like it used to. We explain why.

The way money moves today is fundamentally different from the past. Gone are the days when transactions required physical cash exchanges or long waits for bank transfers. Now, digital payments…

Every update in FinTech is a story of power—we bring them to light.

Every update in FinTech is more than just a software patch or feature release—it’s a shift in the balance of power within the financial ecosystem. From the launch of a…

While banks sleep, code rewrites their future—we don’t miss a line.

In the stillness of night, when traditional banks close their doors and the world seems to pause, an invisible revolution rages on inside data centers and cloud servers worldwide. Code—complex,…

Technology changed the rules of finance. We write about what comes next.

Technology changed the rules of finance. We write about what comes next. The way money moves, grows, and is managed today is no longer confined to traditional banks or outdated…

From silent algorithms to loud headlines—we track what shapes your wallet.

From silent algorithms to loud headlines—we track what shapes your wallet. Behind every financial headline, there’s a complex network of software, data, and decision-making models operating quietly in the background,…

If finance has a software layer, we’re reporting from it.

If finance has a software layer, we’re reporting from it. In today’s world, money doesn’t just flow through banks and ledgers—it flows through code, APIs, algorithms, and digital platforms. This…

The systems that move money are changing. We’re watching them closely.

The systems that move money are changing. We’re watching them closely. From the rise of digital wallets and instant payments to the explosion of decentralized finance and programmable money, the…

Not just finance. Not just tech. Everything in between, explained.

Not just finance. Not just tech. Everything in between, explained. In today’s world, finance and technology aren’t separate—they’re increasingly indistinguishable. But there’s a massive gap between how they’re built and…

Every transaction has a technology—this is where you learn about both.

Behind every transaction—whether it’s a tap at the checkout counter, a bank transfer, a crypto swap, or a click on a digital ad—there’s a system quietly powering the moment. Invisible…

We tell the real stories behind the numbers and the code.

We tell the real stories behind the numbers and the code, because data alone isn’t enough—it’s the human context, the challenges, and the breakthroughs that bring those digits to life.…

How Technology Is Transforming Finance Into a Seamless Digital Experience

Technology is revolutionizing finance, turning what was once a complex and often frustrating process into a seamless digital experience that fits effortlessly into our daily lives. From mobile banking apps…

Money Has Entered the Chat: The Social Side of Financial Technology

Money has entered the chat, quite literally. The rise of social finance—where financial tools and conversations blend seamlessly into social platforms—is redefining how we think about money, community, and influence.…

What Happens When Finance Becomes Frictionless?

When finance becomes frictionless, the barriers that once slowed down or complicated financial interactions disappear, unlocking a world where money moves as effortlessly as information. Friction in finance—whether it’s delays…

APIs, Apps, and Assets: How Digital Infrastructure Is Powering the New Economy

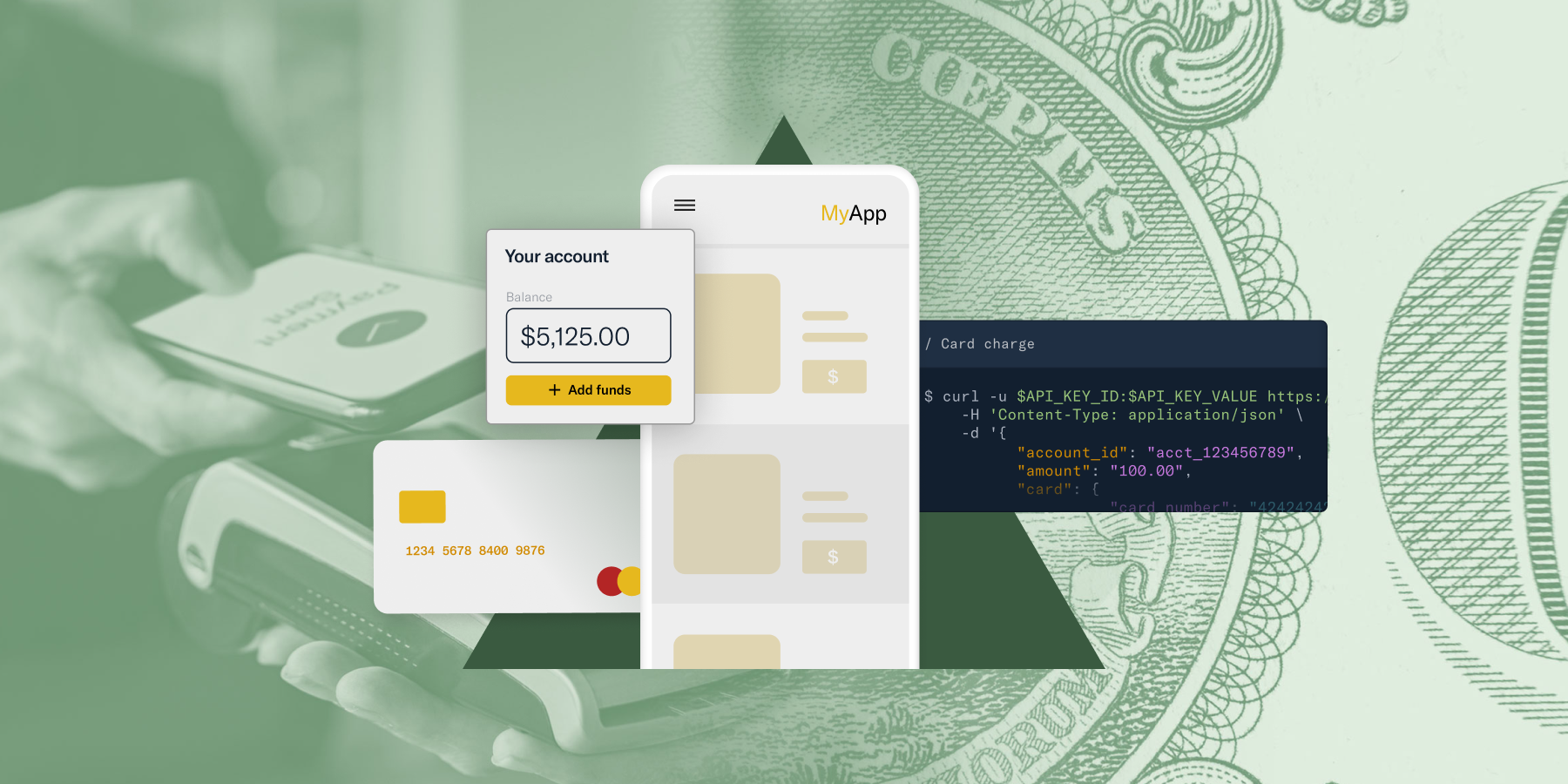

The new economy isn’t just built on traditional capital or labor—it’s powered by digital infrastructure that connects people, businesses, and markets at unprecedented speed and scale. At the heart of…

The End of Old Money: Why the Future of Finance Is Written in Code

The age of old money—rooted in brick-and-mortar banks, paper contracts, and manual ledgers—is rapidly drawing to a close. Today’s financial revolution is being driven not by traditional institutions, but by…

From Spreadsheets to Smart Contracts: The Evolution of Financial Intelligence

Finance has come a long way from the days of manual spreadsheets and ledger books, evolving into a sophisticated ecosystem powered by intelligent software and automated protocols. The shift from…

Not Just Money: How Technology Is Redefining What We Value

Money has long been humanity’s primary measure of value, a universal language for exchange and success. But in today’s rapidly evolving technological landscape, value itself is being redefined beyond mere…

When Finance Stops Being Boring: The Real Stories Behind Fintech Disruption

For decades, finance was the classic “boring” industry—dominated by suits, slow processes, and jargon-heavy reports that few outside the sector cared to understand. But fintech disruption has flipped that script…

Building the Digital Bank of Tomorrow, One Line of Code at a Time

In the age of digital transformation, banks are no longer just financial institutions—they are technology companies, crafting the future of money one line of code at a time. Building the…

Where Algorithms Meet Assets: Exploring the Tech That’s Changing Finance

We are entering a financial era where the most powerful players aren’t necessarily bankers or brokers—but algorithms. In this digital-first landscape, where code drives capital and artificial intelligence executes investment…

Fintech Fuel: Powering the New Economy

In the engine room of today’s global economy, fintech is the fuel that’s accelerating growth, reshaping industries, and democratizing access to capital. No longer confined to niche startups or Silicon…

Money Rewired: Finance at the Speed of Code

In today’s digital economy, money is no longer just printed paper or metal coins—it’s lines of code, data packets, and real-time algorithms moving at the speed of thought. Welcome to…

Swipe, Tap, Invest: Life in a Fintech World

Welcome to life in a fintech world—a fast-paced, hyper-connected environment where swiping, tapping, and investing are as effortless as sending a text. Financial technology has become deeply embedded in our…

Money x Machine: The Fintech Revolution Explored

The fintech revolution—often summed up as “Money x Machine”—is radically transforming the financial world by merging advanced technology with traditional financial systems to create faster, smarter, and more inclusive financial…

Why Startups Are Building Banks Faster Than Banks Can Build Apps

The financial industry is witnessing a seismic shift. While traditional banks have dominated for decades, an accelerating wave of fintech startups is not just creating apps—they are building entire banks…

Finance Is No Longer a Destination—It’s Built Into Your Daily Life

The days when finance was confined to bank branches, separate apps, or monthly statements are rapidly fading. Today, financial services are no longer isolated destinations we visit; they are seamlessly…

How Micro-Transactions Are Powering a New Generation of Digital Consumers

The digital economy is undergoing a subtle yet powerful transformation, driven not by massive one-time purchases, but by countless micro-transactions—small-value payments typically under a few dollars. From in-app purchases and…

Could Your Next Financial Advisor Be a Language Model?

The world of financial advising is on the brink of a revolution, and the catalyst isn’t a new human expert—it’s artificial intelligence, specifically advanced language models like ChatGPT. These AI…

The Shift From Financial Services to Financial Experiences Is Already Underway

Finance has traditionally been seen as a set of services—checking accounts, loans, payments—delivered through static channels like branches, phone calls, or websites. But that model is evolving rapidly. Today, the…

Banking Without Borders: Why Digital Finance Is Breaking Down Global Barriers

In a world once constrained by national borders, currencies, and rigid financial institutions, digital finance is tearing down the walls that once separated economies and people. The rise of fintech,…

How Fintech Is Quietly Redesigning the Global Financial Map

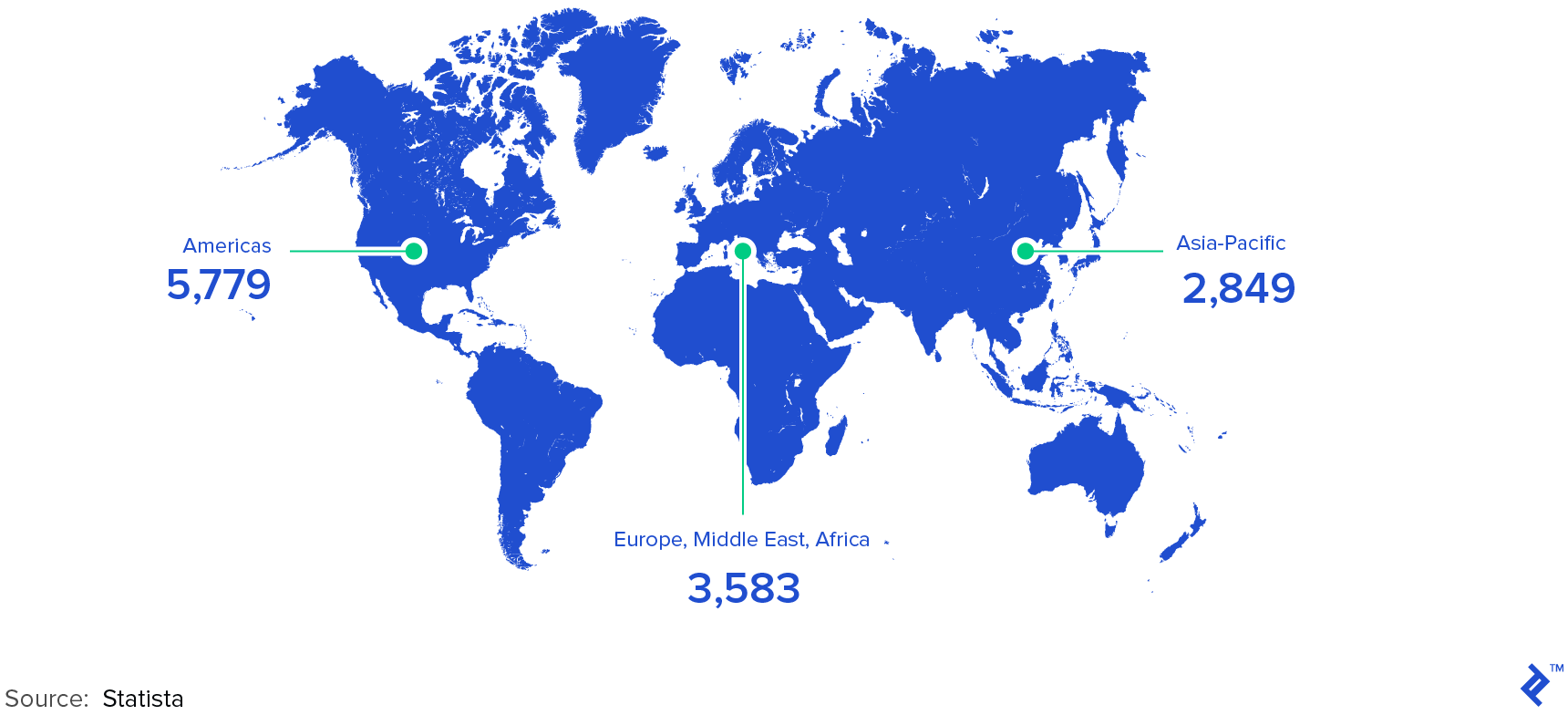

The global financial landscape is undergoing a transformation that many barely notice yet will profoundly impact economies, businesses, and consumers everywhere. Fintech—once a niche sector focused on disrupting payments and…

What Happens to Financial Privacy When Everything Becomes Traceable?

We live in an age where almost every digital action leaves a footprint—and financial transactions are no exception. With the rise of digital payments, blockchain ledgers, open banking, and real-time…

Why the Next Financial Superpower Might Be Built Entirely in the Cloud

The financial landscape is undergoing a tectonic shift. While traditional banking empires have long dominated markets, a new contender is emerging—one not defined by physical branches or legacy systems but…

From Swipe to Stream: How Instant Payments Are Redefining Money Movement

There was a time when moving money meant waiting—waiting for paychecks to clear, for invoices to process, or for transfers to arrive. But that era is ending. With the rise…

Can Embedded Finance Turn Every App Into a Bank?

It’s a bold idea: your favorite shopping app, ride-share platform, or even a gaming service acting like a bank—issuing loans, offering savings tools, or powering real-time payments. This isn’t a…

The Future of Borrowing: What Happens When AI Decides Your Creditworthiness?

Traditionally, borrowing money involved filling out forms, waiting weeks, and relying on a blunt metric: the credit score. But in the age of artificial intelligence, this process is being fundamentally…

How Finance Is Becoming a Feature, Not a Product, in the Tech-Driven Economy

There was a time when financial services stood apart—discrete products offered by traditional banks or specialized institutions. But that era is fading. In today’s tech-driven economy, finance is no longer…

How Embedded Finance Is Changing the Way We Spend, Save, and Invest

Finance is no longer confined to banks or brokerages. It’s becoming an invisible layer woven directly into the apps and platforms we use every day—from ride-hailing services to online marketplaces…

The Role of Technology in Building Trust in a Digital Financial World

In finance, trust is everything. It’s the invisible contract between a bank and its customers, between investors and institutions, between people and their money. But as finance becomes increasingly digital—driven…