Kraken Partners with Mastercard to Enable Crypto Purchases via Mobile Wallets

London – Kraken, one of the world’s leading cryptocurrency exchanges, has announced a strategic partnership with Mastercard to enable seamless crypto purchases via mobile wallets. This collaboration aims to simplify…

Binance and Visa Introduce Seamless Crypto-to-Fiat Conversion at Point of Sale

Global – Binance, one of the world’s largest cryptocurrency exchanges, has relaunched its Binance Connect service in collaboration with Visa, enabling users to convert crypto to fiat instantly and spend…

Crypto.com Partners with Mastercard to Expand Cardholder Access to NFT Marketplaces

Singapore – Crypto.com, a global leader in cryptocurrency exchange and fintech innovation, has announced a strategic partnership with Mastercard to enable seamless access to leading NFT marketplaces for its cardholders.…

BitPay and Visa Launch Crypto Payment Solutions for Global Merchants

Atlanta, GA – In a major move toward mainstream crypto adoption, BitPay, one of the world’s largest blockchain payment processors, has announced a strategic partnership with Visa to launch crypto…

Paypal Teams Up with Circle to Integrate USDC Stablecoin for Everyday Transactions

San Jose, California – PayPal Holdings Inc. (NASDAQ: PYPL) and Circle Internet Financial have announced a strategic partnership to integrate Circle’s USD Coin (USDC) stablecoin into PayPal’s platform, enabling seamless…

Visa and Coinbase Collaborate to Launch Instant Crypto Payments for Millions of Users

San Francisco, CA – Visa (NYSE: V) and Coinbase (NASDAQ: COIN) have announced a strategic partnership to enable real-time cryptocurrency transactions for millions of users across the United States and…

UnityBank Selects FICO to Power AI-Driven Credit Risk and Compliance Models

Lagos, Nigeria – Unity Bank, a leading financial institution in Nigeria, has announced a strategic partnership with FICO, a global provider of analytics and decision management technology, to enhance its…

EcoBank Partners with Quantifind for Enhanced KYC & Adverse Media Screening

EcoBank, one of Africa’s leading financial institutions, has announced a strategic partnership with Quantifind, a global AI-driven financial crime risk intelligence provider. This collaboration is set to strengthen EcoBank’s Know…

TrustBank Collaborates with ComplyAdvantage to Automate Financial Crime Risk Scoring

New York, NY – TrustBank, a leading financial institution, has announced a strategic partnership with ComplyAdvantage, a global data technology company specializing in financial crime risk detection. This collaboration aims…

FinPay and Credify Partner to Boost Lending Solutions for Banks

Philadelphia, USA – FinPay, a leading provider of patient engagement and financial management solutions, has announced a strategic partnership with Credify, a fintech company specializing in embedded finance and digital…

Temenos Integrates Fraud Detection Tools to Expand End-to-End SaaS Banking Platform

Geneva, Switzerland – Temenos, a global leader in banking software, has fortified its end-to-end Software-as-a-Service (SaaS) banking platform by integrating advanced fraud detection tools. This strategic enhancement aims to provide…

Mambu Joins Forces With Solaris and Railsr to Launch Modular Banking Ecosystem

Amsterdam, Netherlands – Mambu, a global leader in cloud banking technology, has announced a strategic partnership with Solaris, Europe’s leading Banking-as-a-Service (BaaS) provider, and Railsr, a fintech infrastructure platform. This…

OpenPay Integrates Risk Scoring Tools from Alloy, Sardine, and Persona

Mexico City, Mexico – OpenPay, a leading Latin American payment platform, has strengthened its fraud prevention capabilities by integrating advanced risk scoring tools from Alloy, Sardine, and Persona. This strategic…

Banking-as-a-Service Platform Synapse Adds New Core API Layers for Cross-Border Use

San Francisco, USA – Synapse Financial Technologies, a prominent banking-as-a-service (BaaS) platform, has expanded its cross-border financial services by partnering with Utoppia, a global fintech company. This collaboration aims to…

Adyen Launches Multi-Currency Settlement with Support from Local FX Partners

Amsterdam, Netherlands – Adyen, a leading global payments platform, has expanded its multi-currency settlement capabilities by forming strategic partnerships with local foreign exchange (FX) providers. This initiative aims to offer…

Payoneer Enhances Global Marketplace Integration With Shopee and MercadoLibre

New York, USA – Payoneer, a leading global payments platform, has expanded its integration with major e-commerce marketplaces Shopee and MercadoLibre, enabling sellers to receive payments in USD and other…

Airwallex Expands Global Payments Stack with New EU & APAC Partnerships

Singapore – Airwallex, a leading global payments and financial platform, has announced strategic partnerships across Europe and Asia-Pacific (APAC) to enhance its global payments infrastructure. These collaborations aim to provide…

Revolut Integrates Local Banking APIs Across LATAM to Boost Coverage

London, UK – Revolut, a leading global fintech platform, has announced the integration of local banking APIs across Latin America (LATAM) to enhance its service offerings in the region. This…

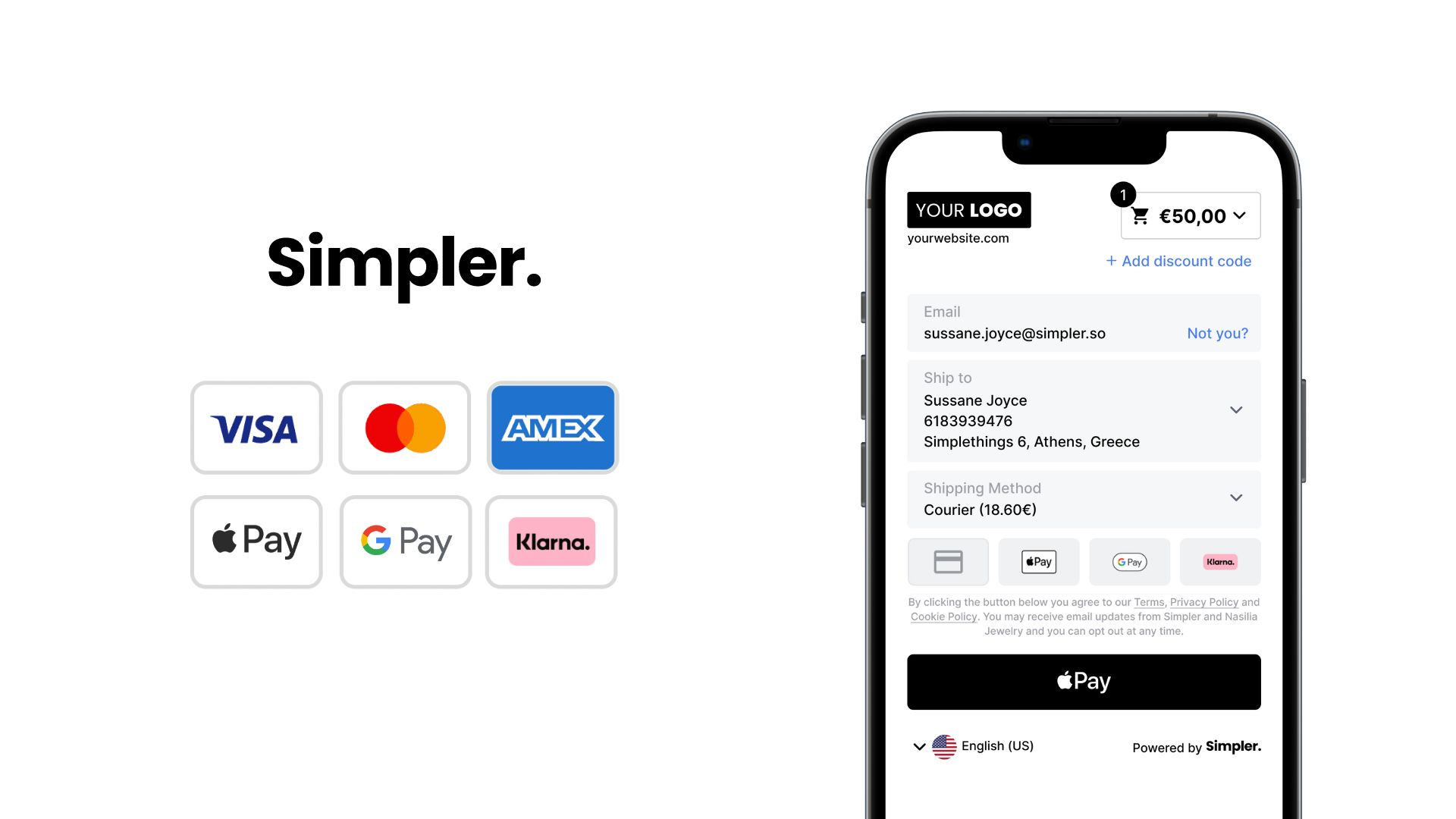

Checkout.com Adds Support for Klarna, Afterpay, and Affirm in Unified Checkout Suite

London, UK – Checkout.com, a global payments solution provider, has expanded its Unified Checkout Suite to include support for leading Buy Now, Pay Later (BNPL) services: Klarna, Afterpay, and Affirm.…

Nium Integrates PayPal, Google Pay, and Apple Pay for Unified Merchant Access

Nium, a global fintech platform, has announced the integration of major digital wallets—PayPal, Google Pay, and Apple Pay—into its merchant services suite. This strategic move aims to streamline payment acceptance…

Currencycloud Connects with Alipay, Venmo, and Zelle to Enhance B2B Transfers

Currencycloud, a leading global payments platform specializing in cross-border transactions, has announced new integrations with major payment networks Alipay, Venmo, and Zelle. This strategic move aims to enhance the speed,…

Marqeta Adds Plaid, Tink, and Yodlee to Card Issuing Platform

Marqeta, the modern card issuing infrastructure provider, has enhanced its platform by integrating leading account connectivity partners—Plaid, Tink, and Yodlee—aimed at simplifying onboarding and ACH payments for businesses using its…

Rapyd Integrates Wise, Payoneer, and Remitly into Global Payout Network

Rapyd has announced the integration of three leading payout partners—Wise, Payoneer, and Remitly—into its global payouts network, marking a significant expansion of its payout ecosystem. This move adds flexibility for…

Airbase and Gusto Explore Strategic Partnership in Employee Financial Wellness

As businesses increasingly seek holistic financial solutions for their employees, fintech leaders Airbase and Gusto are reportedly in exploratory talks for a strategic partnership aimed at deepening employee financial wellness…

Checkout.com Eyes IPO After $200M Series D Extension

Checkout.com, the global payment processor headquartered in London, is reportedly preparing for a potential IPO following a $200 million extension to its Series D funding round. Known for handling payments for…

Novo Raises $75M to Build the “Financial OS” for Solopreneurs

Neobank Novo has announced a $75 million funding round to accelerate the development of what it describes as a “Financial OS” tailored for solopreneurs and self-employed professionals. The announcement was…

Pipe Acquires Funding Circle U.S. to Expand SME Lending Portfolio

Pipe, the innovative fintech platform known for transforming recurring revenue into upfront capital, has announced the acquisition of Funding Circle’s U.S. business. This strategic move aims to bolster Pipe’s small…

Mercury Launches AI-Powered Spend Management Tools for Startups

Mercury, the digital banking platform tailored for startups, has unveiled a suite of AI-driven spend management tools designed to streamline financial operations for small and medium-sized businesses (SMBs). This new…

Wise Rolls Out Real-Time Multi-Currency Payroll for SMBs

Wise, the global technology company specializing in international money transfers, has launched a real-time multi-currency payroll solution designed to streamline global payments for small and medium-sized businesses (SMBs). This new…

Revolut Launches Business Credit Line Product in U.S. Market

Revolut, the global fintech company, has announced the launch of its business credit line product in the U.S. market. This new offering aims to provide small and medium-sized enterprises (SMEs)…

Chime Introduces Early Paycheck Access for Freelancers Nationwide

Chime, the leading digital banking platform, has expanded its services to offer early paycheck access to freelancers across the United States. This move aims to provide greater financial flexibility and…

Ramp Expands Into FX Payments to Support Global Finance Teams

Ramp, the financial operations platform designed to save businesses time and money, has announced the expansion of its services to include foreign exchange (FX) payments, enabling U.S.-based companies to pay…

Visa Collaborates with Brex to Expand Corporate Credit Access for Startups

In a strategic move to enhance financial accessibility for startups, Visa has partnered with Brex to expand corporate credit access tailored specifically for emerging businesses. This collaboration aims to simplify…

Square and Toast Announce Integration to Streamline Restaurant Payments

In a significant development for the restaurant industry, Square and Toast have announced a strategic integration aimed at simplifying payment processes for restaurant operators. This collaboration seeks to enhance operational…

Stripe Partners with Shopify to Power One-Click Checkout for Global Merchants

In a significant development for e-commerce, Stripe has partnered with Shopify to introduce a seamless one-click checkout experience for merchants worldwide. This collaboration aims to streamline the payment process, reduce…

Plaid and QuickBooks Team Up to Simplify Small Business Cash Flow Management

In a major move set to benefit millions of small business owners, Plaid and QuickBooks have announced a new partnership aimed at simplifying cash flow management through seamless financial data…

Inside the Pitch Decks of Fintech’s Biggest Deals

In a world where venture capital is harder to come by and investor scrutiny is higher than ever, some fintech startups are still landing massive funding rounds—and doing it with…

How This Startup Raised Millions in a Down Market

In an investment climate defined by caution, shrinking check sizes, and slower deal cycles, one fintech startup has defied the odds—and raised millions. While global VC funding in 2025 is…

Fintech Startups Changing Finance in Latin America

In 2025, Latin America has become one of the world’s most vibrant regions for fintech innovation. Driven by a young population, high mobile penetration, and widespread distrust in traditional banking,…

These Startups Are Reinventing Lending in 2025

In 2025, the lending landscape looks radically different from just a few years ago. Traditional banks, once gatekeepers of credit access, are being challenged by a new generation of fintech…

The Intersection of IoT and FinTech: New Financial Possibilities

The Intersection of IoT and FinTech: New Financial Possibilities FinTech’s Influence on Corporate Treasury Optimization

FinTech’s Influence on Corporate Treasury Optimization The New Age of Financial Collaboration: FinTech Ecosystems

The New Age of Financial Collaboration: FinTech Ecosystems Why FinTech Should Be at the Heart of Your Digital Strategy

Why FinTech Should Be at the Heart of Your Digital Strategy The Impact of FinTech on Financial Data Transparency

The Impact of FinTech on Financial Data Transparency Transforming Wealth Management with FinTech Innovations

Transforming Wealth Management with FinTech Innovations Unlocking Liquidity with FinTech in Corporate Markets

Unlocking Liquidity with FinTech in Corporate Markets How FinTech is Accelerating Regulatory Compliance for Firms

How FinTech is Accelerating Regulatory Compliance for Firms The Rise of Decentralized Finance (DeFi) in Corporate Finance

The Rise of Decentralized Finance (DeFi) in Corporate Finance Leveraging Big Data to Drive Financial Strategy with FinTech

Leveraging Big Data to Drive Financial Strategy with FinTech Decoding Fintech: Tools Reshaping Personal Finance

Decoding Fintech: Tools Reshaping Personal Finance The Cashless Shift: Future of Payments in a Digital Age

The Cashless Shift: Future of Payments in a Digital Age Beyond Banks: Exploring the Fintech Revolution

Beyond Banks: Exploring the Fintech Revolution